Let’s discuss concerning the well-liked CyberArk Software program Ltd. (NASDAQ:CYBR). The corporate’s shares noticed a major share worth rise of 25% prior to now couple of months on the NASDAQGS. The latest share worth positive aspects has introduced the corporate again nearer to its yearly peak. With many analysts overlaying the large-cap inventory, we might anticipate any price-sensitive bulletins have already been factored into the inventory’s share worth. Nevertheless, may the inventory nonetheless be buying and selling at a comparatively low cost worth? Let’s look at CyberArk Software program’s valuation and outlook in additional element to find out if there’s nonetheless a discount alternative.

View our newest evaluation for CyberArk Software program

Is CyberArk Software program Nonetheless Low cost?

Excellent news, buyers! CyberArk Software program remains to be a discount proper now. Our valuation mannequin exhibits that the intrinsic worth for the inventory is $362.94, which is above what the market is valuing the corporate in the intervening time. This means a possible alternative to purchase low. What’s extra fascinating is that, CyberArk Software program’s share worth is kind of risky, which supplies us extra probabilities to purchase because the share worth may sink decrease (or rise greater) sooner or later. That is based mostly on its excessive beta, which is an effective indicator for a way a lot the inventory strikes relative to the remainder of the market.

What does the way forward for CyberArk Software program appear to be?

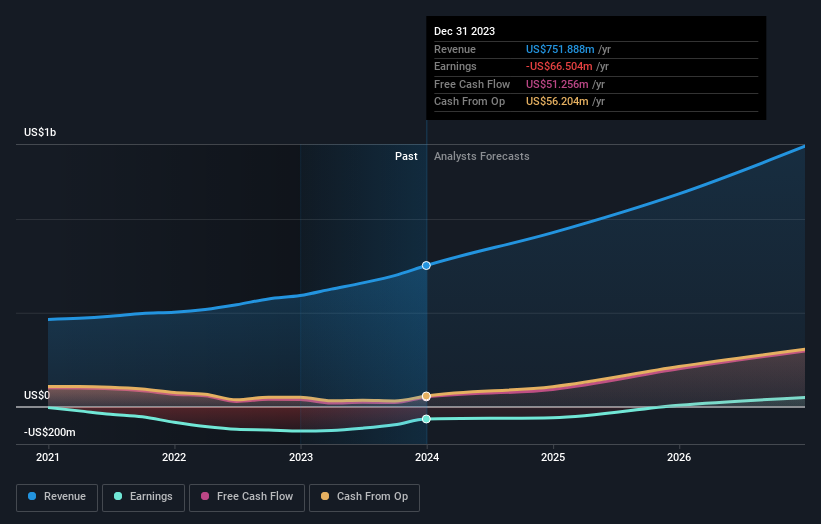

Future outlook is a crucial side once you’re looking to buy a inventory, particularly in case you are an investor searching for development in your portfolio. Though worth buyers would argue that it’s the intrinsic worth relative to the value that matter probably the most, a extra compelling funding thesis could be excessive development potential at an affordable worth. Although within the case of CyberArk Software program, it’s anticipated to ship a comparatively unexciting earnings development of 9.7%, which doesn’t assist construct up its funding thesis. Development doesn’t look like a most important motive for a purchase choice for CyberArk Software program, no less than within the close to time period.

What This Means For You

Are you a shareholder? Despite the fact that development is comparatively muted, since CYBR is at the moment undervalued, it could be a good time to build up extra of your holdings within the inventory. Nevertheless, there are additionally different elements reminiscent of capital construction to think about, which may clarify the present undervaluation.

Are you a possible investor? When you’ve been keeping track of CYBR for some time, now is perhaps the time to enter the inventory. Its future outlook isn’t absolutely mirrored within the present share worth but, which suggests it’s not too late to purchase CYBR. However earlier than you make any funding selections, think about different elements reminiscent of the monitor report of its administration crew, as a way to make a well-informed funding choice.

If you would like to know extra about CyberArk Software program as a enterprise, it is essential to concentrate on any dangers it is going through. At Merely Wall St, we discovered 1 warning signal for CyberArk Software program and we predict they deserve your consideration.

In case you are not enthusiastic about CyberArk Software program, you need to use our free platform to see our listing of over 50 different shares with a excessive development potential.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not CyberArk Software program is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.