Apple in the present day introduced monetary outcomes for its third fiscal quarter of 2023, which corresponds to the second calendar quarter of the yr.

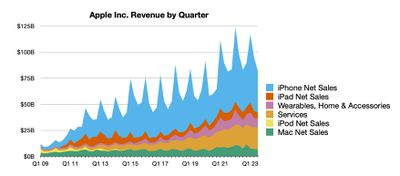

For the quarter, Apple posted income of $81.8 billion and internet quarterly revenue of $19.9 billion, or $1.26 per diluted share, in comparison with income of $83.0 billion and internet quarterly revenue of $19.4 billion, or $1.20 per diluted share, within the year-ago quarter.

Gross margin for the quarter was 44.5 %, in comparison with 43.3 % within the year-ago quarter. Apple additionally declared a quarterly dividend fee of $0.24 per share, payable on August 17 to shareholders of file as of August 14.

“We’re completely happy to report that we had an all-time income file in Companies through the June quarter, pushed by over 1 billion paid subscriptions, and we noticed continued power in rising markets because of strong gross sales of iPhone,” mentioned Tim Prepare dinner, Apple’s CEO. “From schooling to the atmosphere, we’re persevering with to advance our values, whereas championing innovation that enriches the lives of our prospects and leaves the world higher than we discovered it.”

As has been the case for over three years now, Apple is as soon as once more not issuing steerage for the present quarter ending in September.

Apple will present dwell streaming of its fiscal Q3 2023 monetary outcomes convention name at 2:00 p.m. Pacific, and MacRumors will replace this story with protection of the convention name highlights.

Convention name recap forward…

1:40 pm: Apple’s income was down roughly 1% year-over-year, however earnings and earnings per share had been up barely. AAPL shares had been down roughly 0.75% in common buying and selling, briefly spiked after the shut of normal buying and selling, however then dropped once more following the earnings launch and is presently proper round $190 per share.

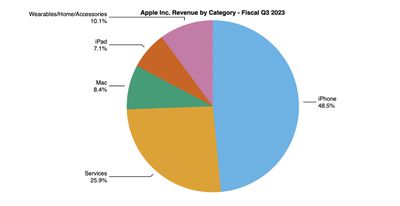

1:42 pm: Apple set an all-time file for Companies income through the quarter at $21.2 billion, however iPhone income was down barely in comparison with the year-ago quarter. Apple Watch was up only a bit, whereas iPad and Mac income dropped considerably to their lowest ranges in three years.

1:55 pm: Whereas Apple’s whole gross sales dropped from simply shy of $83 billion within the June 2022 quarter to only shy of $82 billion this yr, revenue nonetheless climbed from $19.4 billion to $19.9 billion because of a rise within the extremely worthwhile Companies division that greater than offset the drop in {hardware} gross sales.

Between the rise in internet revenue and a lower in excellent shares because of Apple’s repurchase program, earnings per diluted share rose from $1.20 to $1.26.

1:57 pm: Apple additionally noticed gross sales progress in its European and Larger China geographic segments, whereas Americas, Japan, and AsiaPac slipped reasonably. Wearables, House and Equipment joined Companies because the product segments that noticed progress yr over yr.

1:59 pm: Apple holds $10 billion extra in marketable securities than it did on the finish of September 2022, rising from $24.6 to $34 billion, whereas whole excellent time period debt dropped from $99 to $98 billion as increased rates of interest look like taking part in a task in Apple CFO Luca Maestri’s money administration operations.

2:03 pm: The earnings name with analysts is starting, a minute or so late. Apple CEO Tim Prepare dinner and Apple CFO Luca Maestri are on the decision, as regular.

2:04 pm: Tim sounds upbeat, noting that income was higher than expectations. iPhone set June quarter data in an entire host of rising markets plus France, the Netherlands, and Austria.

2:04 pm: Apple has handed 1 billion paid subscriptions on its varied shops.

2:05 pm: On a relentless forex foundation, Apple grew gross sales yr over yr. Count on to listen to the phrases “FX Headwinds” a number of occasions within the subsequent hour.

2:05 pm: Tim is now speaking up Apple Imaginative and prescient Professional and the corporate’s imaginative and prescient for Spatial Computing.

2:06 pm: “Probably the most superior private electronics gadget ever created.”

2:07 pm: Beginning with iPhone. iPhone income was $39.7 billion, down 2% YoY. June quarter file for Switchers and on a relentless forex foundation, gross sales grew. Which means that the power of the US greenback damage Apple’s revenue on worldwide gross sales as overseas forex is turned again into US {dollars} for revenue reporting functions.

Mac down 7% yr over yr, and notes the whole Mac lineup now runs on Apple silicon.

2:08 pm: iPad income was $5.9 billion, down 20% yr over yr, together with a troublesome evaluate due to the timing of the iPad Air launch in 2022.

2:08 pm: Wearables, House and Equipment gross sales had been up 2% yr over yr.

2:10 pm: $21.2 billion in Companies income, with 8% yr over yr enhance, exceeding Apple’s expectations. Information in Video, AppleCare, Cloud, and Fee Companies.

2:10 pm: $10 billion in deposits to Apple Financial savings accounts.

2:11 pm: Touting Lionel Messi becoming a member of InterMiami and MLS.

2:12 pm: Apple opened the Apple On-line Retailer in Vietnam through the quarter and redesigned the primary Apple Retailer in Tysons Nook, Virginia.

2:13 pm: Apple feels strongly about consumer privateness and accessibility.

2:14 pm: Additionally racial justice and fairness.

2:14 pm: Apple is constructing a tradition of belonging and a workforce that displays the communities it serves.

2:16 pm: Tim is popping the decision over to Luca to speak about cash.

2:16 pm: Income was higher than expectations, even with 4% of unfavorable influence from overseas change.

2:17 pm: FX headwinds and an uneven macro atmosphere, hurting Product gross sales. June quarter data for iPhone Switchers and excessive new-to charges for Mac, iPad, and Watch.

2:17 pm: Companies grew 8%, and double digits in fixed forex, with robust efficiency world wide, together with all-time data in Americas and Europe, and June quarter in China and AsiaPac.

2:18 pm: OpEx was under the low finish of the steerage vary offered originally of the quarter, decelerating from the March quarter. Apple is tightening its belts, apparently.

2:19 pm: iPhone income was $39.7 billion, down 2%, however up on fixed forex foundation. Income data in India, Indonesia, the Phillippines, and different international locations. iPhone set up base grew to an all-time excessive because of a June file for Switchers. iPhone 14 household has 98% buyer satisfaction within the US.

2:20 pm: Mac down 7% yr over yr, as transition to Apple Silicon completes. Robust improve exercise plus new prospects, and virtually half of Mac consumers within the quarter had been new to the product.

2:21 pm: Wearables income was up 2% yr over yr, June quarter file in Larger China and powerful performances in a number of rising markets. Apple Watch noticed 2/3 of consumers being new to the product. 98% buyer sat within the US.

2:22 pm: For Companies, Apple set June quarter data for Promoting, App Retailer, and Music. Put in base of two billion energetic gadgets continues to develop, establishing a stable basis for the longer term growth of the ecosystem. Elevated buyer engagement with companies. Transacting and paid accounts grew double-digits, every reaching a brand new all-time excessive. Paid subs confirmed robust progress, surpassing 1 billion paid subscriptions throughout the platform. Up 150 million over the previous yr, and greater than double 3 years in the past.

2:23 pm: Apple entered the quarter with $166 billion in money, paid $7.5 billion in maturing debt plus issuing $5.2 billion in new debt. $109 billion in whole debt. Internet money is $57 billion.

2:24 pm: $24 billion returned to shareholders, together with $18 billion in open-market repurchases of AAPL shares.

2:25 pm: For September, assuming macro outlook does not worsen, FX will proceed to be a headwind. Yr-over-year income influence of over 2%. iPhone YoY efficiency to speed up over June, Mac and iPad to say no double-digits resulting from troublesome compares. Vital pent-up demand within the year-ago quarter.

Gross margin to be between 44 and 45 %. OpEx between $13.5 and $13.7 billion. Tax price to be round 16 %. Money dividend of $0.24 per share, payable on August 17.

2:26 pm: The Q&A is beginning.

2:28 pm: Q: You talked about an uneven macro atmosphere a number of occasions. Are you able to speak on a geographic foundation of developments you are seeing on iPhone?

A: Nice efficiency for iPhone in rising markets, June quarter data in lots of markets. Grew double digits and efficiency was robust in rising markets from China to many different areas, together with India (June file), Indonesia, Southeast Asia, Latin America, Center East. It has been actually good there.

As you’ll be able to see from our geographic segments, we had a slight acceleration of efficiency in Americas, primarily within the US, however we declined there because the smartphone market has been in a decline within the final couple of quarters within the US.

2:29 pm: Q: When it comes to gross margin, you had been on the excessive finish of the vary. You are guiding to 44-45 now, which I feel is the very best I’ve seen. Looks like there’s an ideal storm of excellent issues.

A: I feel you bear in mind accurately, it was an all-time file for us in June. Up 20 bp sequentially, pushed by value financial savings and mix-shift in direction of Companies which helps firm gross margins, offset by seasonal lack of leverage. Commodity atmosphere is favorable to us. Our product combine is sort of robust. Except overseas change, which continues to be a big drag, we’re in a very good place for the June quarter and we anticipate related ranges of gross margin for a similar causes, frankly, for the September quarter.

2:32 pm: Q: Are you able to give further shade round steerage? You known as out FX influence on iPhone, is that fixed forex or is there one thing altering on seasonality that’s inflicting not as a lot step up in product income?

A: We do not report in fixed forex, however we’re additionally mentioning iPhone progress however double-digit decline for Mac and iPad resulting from year-ago manufacturing unit shutdowns that had been alleviated and crammed pent-up demand final yr through the September quarter. An uncommon quantity of exercise a yr in the past, so each iPad and Mac down double-digits, offsetting an anticipated progress in iPhone and Companies.

2:33 pm: Q: What quantity of iPhones are bought on an installment vs up entrance foundation globally, and do you anticipate large promotions on iPhone from US carriers this yr?

A: We have finished a very good job with affordability packages world wide, each in our direct channel and with our companions world wide. The vast majority of iPhones at this level are bought utilizing some sort of a program, trade-in, installments, some sort of financing. That proportion, properly over 50%, could be very related throughout developed and rising markets. We wish to do extra of that as a result of we expect it helps the affordability threshold of our merchandise. It helped our product combine throughout the final couple of cycles.

2:36 pm: Q: To be clear, you are speaking about an acceleration on iPhone however the comp is 2% simpler on FX, is {that a} like for like foundation from June to September quarter? Final quarter you talked about shopping for stock at favorable costs, the place do you sit in the present day and what is the timing and period of that commodity backlog and subsequent quarters from a positive value dynamic?

A: Re our steerage, we’re referring totally to reported numbers, bearing in mind that we’ve a slight enchancment on overseas change. Related efficiency, I check with reported efficiency in June versus reported efficiency in September. On a reported foundation, we anticipate iPhone and Companies efficiency to speed up, and iPad and Mac to say no double digits.

On a commodity entrance, the atmosphere is favorable. We all the time be sure that we reap the benefits of the alternatives accessible available in the market and we are going to proceed to try this going ahead.

Q: Any sense of how lengthy of a runway that offers you, any sense of a short-term tailwind?

A: I do not wish to speculate past the September quarter as a result of that is how far we information. 44-45 gross margin, which is traditionally very excessive, which displays a positive atmosphere for us.

2:38 pm: Q: Are there indicators customers will spend on client electronics, are there areas the place you see extra client power and the way sustainable is that?

A: We did exceptionally properly in rising markets final quarter, and even higher on a relentless forex foundation. Rising markets had been a power. China, we went from a -3 in Q2 to a +8 in Q3. Have a look at the US, the Americas section, there was a slight acceleration sequentially, although Americas barely declining yr over yr. Main motive for that’s that it is a difficult smartphone market within the US presently.

Europe noticed a file June quarter, so some actually good indicators in most locations on the planet.

2:40 pm: Q: 3 quarters with OpEx rising under seasonality or under expectations, first time we have seen R&D rising lower than 10% since 2007? What’s providing you with the thought of a extra common seasonal cadence of R&D or is that this the brand new regular?

A: We take a look at the atmosphere and this has been an unsure interval over the previous few quarters. Being cautious controlling our spend throughout the corporate, been fairly efficient at slowing down the spend. We slowed down hiring inside the firm in a number of areas, and we’re more than happy with our means to decelerate a number of the expense progress, bearing in mind the general macro state of affairs. We are going to proceed to handle intentionally, we proceed to develop our R&D prices sooner than the remainder of the corporate. Our focus continues to be on innovation and product improvement and we proceed to try this.

2:42 pm: Q: Encouraging to see Companies outperformance within the quarter and extra anticipated subsequent quarter, are you able to speak extra about key underlying drivers for confidence in Companies subsequent quarter, something to name out because it pertains to issues in Apple Search Adverts, making plenty of investments in AppleTV+.

A: We have seen an enchancment within the June quarter and we anticipate additional enhancements in September. In June, efficiency throughout the board, we set data. All-time data in Cloud, Video, AppleCare, Funds. June quarter data in App Retailer, Promoting, Music. We noticed enhancements in all Companies classes. We expect the state of affairs will proceed to enhance as we undergo September and that is very constructive. Not solely good for monetary outcomes, but it surely exhibits a excessive stage of engagement of our prospects within the ecosystem. The sum of the entire issues that I discussed in my ready remarks.

Our set up base continues to develop, a bigger pool of consumers, extra transacting and paid accounts, the subscription enterprise could be very wholesome with progress of 150 million paid subscriptions simply within the final 12 months. Virtually double what we had three years in the past. The mixture of all of these items offers us good confidence for September.

2:44 pm: Q: Re {hardware} set up base and companies ARPU, with Companies power and a pair of billion put in base, do you concentrate on it on a per energetic iPhone consumer foundation or per gadget foundation? Do you suppose there’s an incremental alternative for customers who’ve a number of gadgets for an ARPU uplift?

A: Clients who personal a couple of gadget are extra engaged in our ecosystem. They spend extra on the Companies entrance, however the largest alternatives that we all know, lots of our prospects are very accustomed to our ecosystem. Some are utilizing solely the portion of the ecosystem that’s free, by providing extra content material over time, we consider we are able to entice extra of them as paid prospects.

2:46 pm: Q: How do you concentrate on Wearables going into September, you have not talked a lot about that.

A: We had actually good efficiency in Larger China, essential for us, a June quarter file for Larger China. The engagement with the ecosystem in a market that’s so vital, continues to develop. An increasing number of prospects. We proceed to develop the put in base of the class shortly. 2/3 of Apple Watch consumers within the June quarter was new to the product. That’s all additive to the put in base. Nice to see that the AirPods proceed to be an amazing success within the market. Issues are transferring in the best path there. A fantastic enterprise for us, $40 billion within the final 12 months, almost the dimensions of a Fortune 100 firm. Diversified each our revenues and our earnings.

2:47 pm: Q: Europe progress, up 5% is pretty notable. Just a few rising markets in Europe, however what’s occurring in Europe and what ought to we give it some thought in Western vs rising markets?

A: Primarily good on the rising markets aspect of Europe, India, Center East are in “Europe” section. A variety of markets that did properly, France, Italy, Netherlands, Austria. It was a very good quarter for Europe.

2:49 pm: Q: For a while now, you’ve got had a forex headwind. It is conceivable that it would begin to come down subsequent yr, and the greenback weakens. How would that have an effect on revenues and price?

A: We attempt to hedge our FX exposures as a result of we expect it is the best strategy for the corporate when it comes to minimizing volatility throughout the motion of currencies. We can’t successfully hedge each single publicity world wide as a result of in some circumstances it is not potential, in others it’s prohibitively costly. We are likely to cowl all the key forex pairs we’ve. About 60% of our enterprise is outdoors the US, so it is a very giant and really efficient hedging program.

We arrange these hedges, they usually are likely to roll over very often, and we change them with new hedges on the new spot price. Influence on income and price will rely the place spot charges are at completely different time limits. Due to this fact, due to the best way this system works, that must be a little bit of a lag in each instructions because the overseas change strikes over time.

2:50 pm: Q: To assist people improve, money rebate or trade-in, as you get into the December quarter, are you conscious of packages which can be in place? You mentioned greater than 50% of telephones are bought by means of the packages, I assume it is even increased within the US.

A: I do not wish to get into specifics of various carriers, however typically talking I might suppose that it could be fairly simple to discover a promotion on a cellphone offered you are hooking as much as a service and both switching companies/carriers or upgrading your cellphone on the similar service. Each of these circumstances, in the present day, you’ll find promotions on the market. I anticipate you’d be capable of discover these within the December timeframe as properly.

2:52 pm: Q: Tim, strategically, as we take into consideration companies progress and the content material growth behind that, what have you ever seen from a sports activities perspective with the engagement with MLS and MLB, how strategically are you occupied with growth in sports activities as a companies driver?

A: We’re centered on unique content material with Apple TV+, we’re about giving storytellers a venue to inform nice tales and get us to suppose a bit deeper. Sport is the last word unique story and for MLS we couldn’t be happier with how the partnership goes. It is clearly within the early days, however we’re beating our expectations when it comes to subscribers and the truth that Messi went to Inter Miami helped us on the market a bit. We’re very enthusiastic about it.

2:54 pm: Q: An replace on the continued progress in India, how will we take into consideration that market alternative going ahead? Is there something that would speed up the chance for iPhones in that giant cellular market?

A: We hit a June quarter income file in India. We grew robust double digits. We opened our first two retail shops through the quarter, and it is early going presently however they’re presently beating our expectations when it comes to how they’re doing. We’re persevering with to work on constructing out the channel and placing extra funding in our direct to client gives as properly. I feel if you happen to take a look at it, it is the second largest smartphone market on the planet. We should be doing rather well, and I am actually happy with our progress there however we nonetheless have a really modest and low share within the smartphone market. It is an enormous alternative for us and we’re placing all of our energies into making that happen.

2:56 pm: Q: How do you see your funding in AI, is it about constructing a sooner improve cycle or increased ASP, or constructing companies?

A: AI and ML is integral to each product we construct. Take into consideration WWDC and options coming in iOS 17, dwell voicemail, earlier options like crash or fall detection, these would not be potential with out AI and machine studying. We have been doing analysis throughout a variety of AI tech, together with generative AI, for years. We are going to proceed to responsibly advance our merchandise with these applied sciences with a aim of enriching individuals’s lives. We announce issues as they arrive to market, that is our MO and I would like to stay to that.

2:57 pm: Q: Discuss VIsion Professional?

A: We’re very enthusiastic about Imaginative and prescient Professional; everybody who has gone by means of the demos have been blown away, whether or not speaking concerning the press or builders or analysts. We’re wanting ahead to delivery early subsequent yr. We’re not going to forecast revenues and so forth on the decision in the present day, however we’re very enthusiastic about it.

2:59 pm: Q: On iPhone, Tim you talked about a file variety of switchers on the quarter. Given weak macro and client spending, how’s the alternative cycle for iPhone? Related, longer or shorter to prior years?

A: Switchers had been a really key a part of our iPhone outcomes for the quarter, we set a file in Larger China and it was on the coronary heart of our outcomes there. We proceed to attempt to persuade increasingly individuals to modify, due to the expertise and the ecosystem we are able to supply them. We expect switching is a big alternative for us. When it comes to the improve cycle, it is troublesome to estimate in actual time what’s going on with the improve cycle.

Take into consideration iPhone outcomes yr over yr, it’s important to take into consideration the SE announcement within the yr in the past quarter, that gives a little bit of a headwind on the comp. As Luca mentioned as he talked about how we view This autumn, we see iPhone accelerating in This autumn.

3:00 pm: Q: On retail, many new shops appear to have been open for greater than a yr. How did retail site visitors look and what does that recommend for the again half of the yr?

A: In case you take a look at retail, it is a key a part of our go-to-market strategy. It will likely be so key and a aggressive benefit with Imaginative and prescient Professional and it’ll give us a chance to launch a brand new product and demo to individuals within the shops. It has many benefits in it, and we proceed to roll out extra shops. Opened two in India final quarter. Nonetheless lots of international locations on the market that do not have Apple Shops that we wish to go into. We proceed to see it as a key a part of how we go to market and we love the expertise that we are able to present prospects there.

3:00 pm: The decision has ended!