Some buyers depend on dividends for rising their wealth, and in case you’re a kind of dividend sleuths, you is likely to be intrigued to know that E & M Computing Ltd. (TLV:EMCO) is about to go ex-dividend in simply 4 days. The ex-dividend date is one enterprise day earlier than an organization’s document date, which is the date on which the corporate determines which shareholders are entitled to obtain a dividend. The ex-dividend date is essential as the method of settlement entails two full enterprise days. So in case you miss that date, you wouldn’t present up on the corporate’s books on the document date. Due to this fact, if you are going to buy E & M Computing’s shares on or after the 4th of April, you will not be eligible to obtain the dividend, when it’s paid on the seventeenth of April.

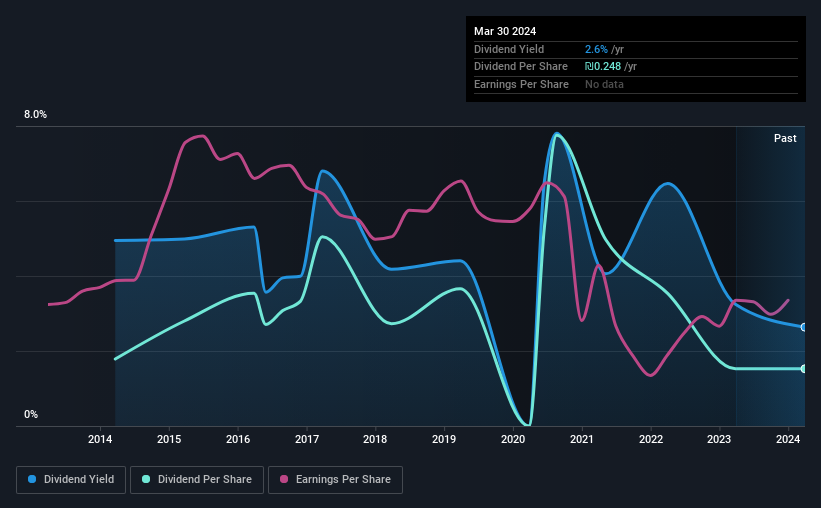

The corporate’s upcoming dividend is ₪0.135 a share, following on from the final 12 months, when the corporate distributed a complete of ₪0.25 per share to shareholders. Final yr’s complete dividend funds present that E & M Computing has a trailing yield of two.6% on the present share worth of ₪9.41. Dividends are a serious contributor to funding returns for long run holders, however provided that the dividend continues to be paid. That is why we should always at all times examine whether or not the dividend funds seem sustainable, and if the corporate is rising.

View our newest evaluation for E & M Computing

Dividends are normally paid out of firm earnings, so if an organization pays out greater than it earned then its dividend is normally at better threat of being lower. E & M Computing paid out simply 16% of its revenue final yr, which we predict is conservatively low and leaves loads of margin for sudden circumstances. A helpful secondary examine could be to judge whether or not E & M Computing generated sufficient free money stream to afford its dividend. The excellent news is it paid out simply 11% of its free money stream within the final yr.

It is optimistic to see that E & M Computing’s dividend is roofed by each earnings and money stream, since that is typically an indication that the dividend is sustainable, and a decrease payout ratio normally suggests a better margin of security earlier than the dividend will get lower.

Click on right here to see how a lot of its revenue E & M Computing paid out during the last 12 months.

Have Earnings And Dividends Been Rising?

When earnings decline, dividend firms develop into a lot more durable to analyse and personal safely. If earnings fall far sufficient, the corporate might be pressured to chop its dividend. Readers will perceive then, why we’re involved to see E & M Computing’s earnings per share have dropped 12% a yr over the previous 5 years. In the end, when earnings per share decline, the scale of the pie from which dividends could be paid, shrinks.

The principle means most buyers will assess an organization’s dividend prospects is by checking the historic price of dividend development. E & M Computing’s dividend funds per share have declined at 1.6% per yr on common over the previous 10 years, which is uninspiring.

Ultimate Takeaway

From a dividend perspective, ought to buyers purchase or keep away from E & M Computing? Earnings per share are down meaningfully, though at the very least the corporate is paying out a low and conservative proportion of each its earnings and money stream. It is undoubtedly not nice to see earnings falling, however at the very least there could also be some buffer earlier than the dividend must be lower. General, it is not a foul mixture, however we really feel that there are doubtless extra engaging dividend prospects on the market.

With that in thoughts, a crucial a part of thorough inventory analysis is being conscious of any dangers that inventory at the moment faces. As an example, we have recognized 3 warning indicators for E & M Computing (2 make us uncomfortable) you need to be conscious of.

Typically, we would not suggest simply shopping for the primary dividend inventory you see. This is a curated checklist of fascinating shares which might be sturdy dividend payers.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not E & M Computing is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.