Whether or not you’re a beginner to the micro-investing house or a seasoned professional, having the appropriate platform tailor-made to your investing targets is without doubt one of the major keys to success. One platform value contemplating is Syfe.

Syfe at a look

- Based in Singapore in 2019, Syfe operates throughout Singapore, Hong Kong and Australia.

- Put money into US shares and ETFs from $1.49 and ASX shares and ETFs from $4.99.

- ‘Good Baskets’ function offers buyers the power to purchase a number of ETFs in a single order at considerably decreased brokerage.

What’s Syfe?

Syfe is a digital funding platform tailor-made to assist buyers construct their wealth in a method that most accurately fits their monetary place.

Based in Singapore in 2019, Syfe now additionally operates in Hong Kong and Australia, and has about 100,000 customers.

Chatting with Financial savings.com.au, Syfe Common Supervisor and Nation Head for Australia Tim Wallace (pictured above) stated there was an actual alternative to deliver subtle funding instruments and techniques usually reserved for these both with excessive internet value or institutional buyers to on a regular basis retail buyers.

“It doesn’t matter what geography you are in, whether or not you are an Australian or Singaporean, in relation to investing, individuals are confronted with data overload and competing priorities in relation to saving and investing,” Mr Wallace stated.

“Folks ask, do I put my cash in my mortgage offset or checking account, or do I get it to work by investing it?

“These are actual questions that individuals ask themselves day-after-day. Even when of us have the will to develop their wealth, there’s boundaries to entry, like lack of time, persistence, lack of understanding.

“Compounding that is that, there’s actually a scarcity of present options that fail typically to resolve the friction and issues that individuals face to develop their wealth. The web consequence being that a big portion of society actually will not be optimising their investments and financial savings primarily based on their very own circumstances.

“Syfe exists to resolve that.”

What separates Syfe from the micro-investing pack?

With a seemingly limitless variety of choices to select from within the micro-investing house, Syfe goals to distinguish itself from the likes of Superhero, Selfwealth and CommSec by means of simplicity.

“Buyers are confronted with an abundance of choices, in relation to which funding platforms to make use of and make investments by means of,” Mr Wallace stated.

“Selection could be a great point, as a result of it actually offers buyers the facility to select what works for them. It might additionally get actually complicated and overbearing on determining the place to begin truly, for lots of people.

“A key mantra for us at Syfe is to simplify that complexity. So from when an investor is considering who to make use of, proper by means of to after they’re truly inserting their trades, we need to make that investor expertise easy however highly effective and environment friendly.”

Mr Wallace stated Syfe’s key differentiators embrace low value entry to Australian and US markets – from as little as one share in Australia and $1 within the US – and funding instruments like ‘Good Baskets’ (defined beneath).

“It’s fairly a complicated provide, however finished very merely. It offers folks the facility to diversify very simply alongside free insights, like analysts’ suggestions on shares, market information and academic content material.

“The sum complete of all of these elements does separate us available in the market, and actually offers buyers of all ranges with some nice instruments and capabilities to get probably the most out of constructing wealth.”

What portfolios does Syfe provide?

Syfe doesn’t provide clients the chance to put money into default premixed portfolios like a spread of different micro-investing apps, as a substitute serving as a platform or middleman supply for buyers.

“Syfe Australia would not provide issues like managed funding schemes or managed funds that we function but, nonetheless, we do provide buyers entry to change traded funds, or ETFs on the Australian and US markets,” Mr Wallace stated.

“So they’re successfully portfolios in their very own proper, which might be listed on inventory exchanges.”

Syfe options and costs

‘Good Baskets’

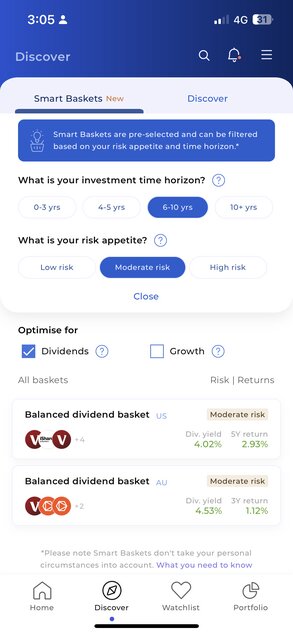

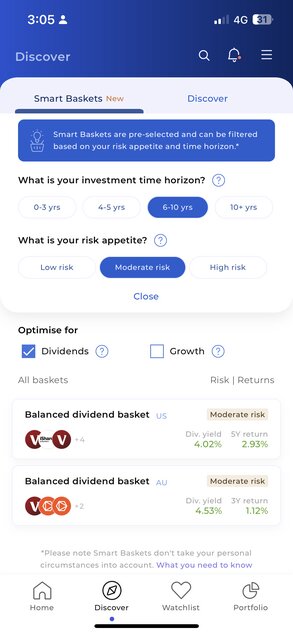

Syfe’s ‘crown jewel’ setting the platform aside from different micro-investing apps is a function referred to as ‘Good Baskets’ (pictured beneath).

“The ‘Good Baskets’ function permits buyers to buy a number of ETFs in a single order at a considerably decreased brokerage price,” Mr Wallace stated.

“So the place usually you’ll have beforehand required a number of orders to do that, we have simplified it down into one. These orders are pre-built by our wealth professionals, that customers can filter primarily based on their funding time horizon and their desired danger tolerance.

“By combining various ETFs, you may get the facility out of what every particularly focuses on, additional diversifying in opposition to the issues that you just need to obtain. That functionality, mixed with the power to filter the period of time that you just need to make investments over and danger tolerance is one thing distinctive to the Australian market given its simplicity but additionally energy.”

Charges

For investing within the Australian market, Syfe expenses a brokerage payment of $4.99 per commerce below $20,000. Trades over $20,000 are charged 0.025% of the commerce worth.

For instance, when you made a $25,000 commerce, you’d pay $6.25 in brokerage.

Syfe notes there are not any different prices related to buying and selling on the ASX with Syfe, equivalent to market information charges and contract charges.

Right here’s how Syfe stacks as much as a few of competitors within the micro-investing house:

- CommSec Pocket: $2 per commerce for investments below $1,000; or 0.2% of commerce worth for quantities over $1,000.

- Stake: US & ASX – $3; Account charges: 0.7% conversion payment for AUD to USD, with a minimal conversion payment of USD $2.

- Douugh: $2.99 month-to-month payment for portfolio steadiness of $50 USD; $2.99 payment for limitless share buying and selling.

- Kwala: $0 brokerage; $2-4 per thirty days payment, minimal funding $10.

How you can obtain a diversified portolio

To attain a diversified portfolio, Mr Wallace says there’s no silver bullet, given every investor has completely different targets and timelines.

“By investing in in a mixture of issues, buyers can cut back their publicity to anyone funding or trade,” he stated.

“In consequence, this will enhance the possibilities of attaining extra constant returns.

“The saying do not put all of your eggs in a single basket, that’s what diversification at its core is all about.”

Mr Wallace famous step one to attaining a diversified portfolio, regardless of whether or not you’re a seasoned professional or investing for the primary time, is objective setting.

“This a private reflection on issues like your individual functionality to speculate, why you are investing, the technique that you just need to observe, how tolerant you’re to danger in opposition to that technique, how lengthy you need to make investments for, after which the precise targets you are attempting to realize,” he stated.

“For instance, anyone investing over a shorter time period time interval, say three years, can have or ought to have a unique method to somebody investing over, say 30 years. Whereas each ought to be diversified, once more, the precise issues that they put money into, and the chance they take, will possible be completely different over these two completely different time time horizons.

“So when it comes time to speculate, happily immediately, buyers have improbable instruments at their fingertips, which allow them to diversify each rapidly and likewise fairly effectively. Trade traded funds (ETFs) put money into a broad vary of asset sectors in a single buy. There’s by no means been a better time or more economical time for buyers to have the ability to get the advantages of diversification with out having to pick dozens of particular person shares.”

Regardless of a seemingly limitless variety of choices to select from, Mr Wallace stated this will depart buyers with extra questions than solutions.

“The confusion buyers face is that they know they need to put money into ETFs to realize diversification, however there’s so a lot of them both on the US market or the Australian market {that a} paralysis of selection exists.

“I believe for many individuals, that may truly cause them to not even make investments, as a result of they do not perceive what they’re truly doing.

“By means of Syfe’s ‘Good Baskets’ function, customers can can filter primarily based on their very own preferences, time horizon and danger tolerance, targeted on market or revenue or progress, and actually choose the appropriate pre-built bundle of orders for them, which we really feel is sort of highly effective on this age to have a variety of selection.

Mr Wallace stated one other issue to think about as a strong add-on to diversification is constant funding.

“If constant funding is finished frequently, over time, it does allow an investor to make the most of the peaks and troughs that naturally happen available in the market and probably cut back their danger of funding over time,” he stated.

Tricks to get began with micro-investing

That can assist you get began in your micro-investing journey, Mr Wallace outlined just a few tips that could hold entrance of thoughts.

“The very first thing is there’s there’s by no means an ideal time to get into the market. Even the most effective inventory pickers on the earth battle to time this,” he stated.

“What’s most vital for almost all of us is now that you just’re available in the market, you are constant together with your funding, and also you’re true to your funding technique.

“Micro-investing is a very wonderful means for buyers to get began, not solely to be taught and construct confidence, but additionally to speculate at a stage that is snug for their very own circumstances. That stated there is no tried and true definition of micro-investing.

“Investing by and huge is you in the end wanting a platform that allows you to make investments how you want, whether or not that is small and constant or massive and rare. So Syfe was constructed with that in thoughts.

“We needed to scale back these boundaries to entry that a variety of buyers face, together with this notion that you just want some huge cash to begin investing.

“Overwhelming majority of oldsters assume you want like a minimal of $1,000 bucks to get the ball rolling – there’s even a big portion that assume you want a minimal of $10,000 to begin investing.

“Syfe permits buyers to purchase into the US market from as little as $1 and the Aussie market from as little as one share. This, mixed with our low value brokerage is a improbable method for buyers to get began, get constant and construct their wealth long run.”

Commercial

Want someplace to retailer money and earn curiosity? The desk beneath options financial savings accounts with a number of the highest rates of interest available on the market.

- Get a Welcome bonus of $20. Simply make 3 purchases within the 1st 30 days

- Use code: BONUS20

- T&Cs apply

All merchandise with a hyperlink to a product supplier’s web site have a industrial advertising relationship between us and these suppliers. These merchandise could seem prominently and first inside the search tables no matter their attributes and will embrace merchandise marked as promoted, featured or sponsored. The hyperlink to a product supplier’s web site will mean you can get extra data or apply for the product.

By de-selecting “Present on-line companions solely” extra non-commercialised merchandise could also be displayed and re-sorted on the prime of the desk. For extra data on how we’ve chosen these “Sponsored”, “Featured” and “Promoted” merchandise, the merchandise we examine, how we earn a living, and different vital details about our service, please click on right here. Charges right as of Could 8, 2023. View disclaimer.

Photographs equipped.

Whether or not you’re a beginner to the micro-investing house or a seasoned professional, having the appropriate platform tailor-made to your investing targets is without doubt one of the major keys to success. One platform value contemplating is Syfe.

Syfe at a look

- Based in Singapore in 2019, Syfe operates throughout Singapore, Hong Kong and Australia.

- Put money into US shares and ETFs from $1.49 and ASX shares and ETFs from $4.99.

- ‘Good Baskets’ function offers buyers the power to purchase a number of ETFs in a single order at considerably decreased brokerage.

What’s Syfe?

Syfe is a digital funding platform tailor-made to assist buyers construct their wealth in a method that most accurately fits their monetary place.

Based in Singapore in 2019, Syfe now additionally operates in Hong Kong and Australia, and has about 100,000 customers.

Chatting with Financial savings.com.au, Syfe Common Supervisor and Nation Head for Australia Tim Wallace (pictured above) stated there was an actual alternative to deliver subtle funding instruments and techniques usually reserved for these both with excessive internet value or institutional buyers to on a regular basis retail buyers.

“It doesn’t matter what geography you are in, whether or not you are an Australian or Singaporean, in relation to investing, individuals are confronted with data overload and competing priorities in relation to saving and investing,” Mr Wallace stated.

“Folks ask, do I put my cash in my mortgage offset or checking account, or do I get it to work by investing it?

“These are actual questions that individuals ask themselves day-after-day. Even when of us have the will to develop their wealth, there’s boundaries to entry, like lack of time, persistence, lack of understanding.

“Compounding that is that, there’s actually a scarcity of present options that fail typically to resolve the friction and issues that individuals face to develop their wealth. The web consequence being that a big portion of society actually will not be optimising their investments and financial savings primarily based on their very own circumstances.

“Syfe exists to resolve that.”

What separates Syfe from the micro-investing pack?

With a seemingly limitless variety of choices to select from within the micro-investing house, Syfe goals to distinguish itself from the likes of Superhero, Selfwealth and CommSec by means of simplicity.

“Buyers are confronted with an abundance of choices, in relation to which funding platforms to make use of and make investments by means of,” Mr Wallace stated.

“Selection could be a great point, as a result of it actually offers buyers the facility to select what works for them. It might additionally get actually complicated and overbearing on determining the place to begin truly, for lots of people.

“A key mantra for us at Syfe is to simplify that complexity. So from when an investor is considering who to make use of, proper by means of to after they’re truly inserting their trades, we need to make that investor expertise easy however highly effective and environment friendly.”

Mr Wallace stated Syfe’s key differentiators embrace low value entry to Australian and US markets – from as little as one share in Australia and $1 within the US – and funding instruments like ‘Good Baskets’ (defined beneath).

“It’s fairly a complicated provide, however finished very merely. It offers folks the facility to diversify very simply alongside free insights, like analysts’ suggestions on shares, market information and academic content material.

“The sum complete of all of these elements does separate us available in the market, and actually offers buyers of all ranges with some nice instruments and capabilities to get probably the most out of constructing wealth.”

What portfolios does Syfe provide?

Syfe doesn’t provide clients the chance to put money into default premixed portfolios like a spread of different micro-investing apps, as a substitute serving as a platform or middleman supply for buyers.

“Syfe Australia would not provide issues like managed funding schemes or managed funds that we function but, nonetheless, we do provide buyers entry to change traded funds, or ETFs on the Australian and US markets,” Mr Wallace stated.

“So they’re successfully portfolios in their very own proper, which might be listed on inventory exchanges.”

Syfe options and costs

‘Good Baskets’

Syfe’s ‘crown jewel’ setting the platform aside from different micro-investing apps is a function referred to as ‘Good Baskets’ (pictured beneath).

“The ‘Good Baskets’ function permits buyers to buy a number of ETFs in a single order at a considerably decreased brokerage price,” Mr Wallace stated.

“So the place usually you’ll have beforehand required a number of orders to do that, we have simplified it down into one. These orders are pre-built by our wealth professionals, that customers can filter primarily based on their funding time horizon and their desired danger tolerance.

“By combining various ETFs, you may get the facility out of what every particularly focuses on, additional diversifying in opposition to the issues that you just need to obtain. That functionality, mixed with the power to filter the period of time that you just need to make investments over and danger tolerance is one thing distinctive to the Australian market given its simplicity but additionally energy.”

Charges

For investing within the Australian market, Syfe expenses a brokerage payment of $4.99 per commerce below $20,000. Trades over $20,000 are charged 0.025% of the commerce worth.

For instance, when you made a $25,000 commerce, you’d pay $6.25 in brokerage.

Syfe notes there are not any different prices related to buying and selling on the ASX with Syfe, equivalent to market information charges and contract charges.

Right here’s how Syfe stacks as much as a few of competitors within the micro-investing house:

- CommSec Pocket: $2 per commerce for investments below $1,000; or 0.2% of commerce worth for quantities over $1,000.

- Stake: US & ASX – $3; Account charges: 0.7% conversion payment for AUD to USD, with a minimal conversion payment of USD $2.

- Douugh: $2.99 month-to-month payment for portfolio steadiness of $50 USD; $2.99 payment for limitless share buying and selling.

- Kwala: $0 brokerage; $2-4 per thirty days payment, minimal funding $10.

How you can obtain a diversified portolio

To attain a diversified portfolio, Mr Wallace says there’s no silver bullet, given every investor has completely different targets and timelines.

“By investing in in a mixture of issues, buyers can cut back their publicity to anyone funding or trade,” he stated.

“In consequence, this will enhance the possibilities of attaining extra constant returns.

“The saying do not put all of your eggs in a single basket, that’s what diversification at its core is all about.”

Mr Wallace famous step one to attaining a diversified portfolio, regardless of whether or not you’re a seasoned professional or investing for the primary time, is objective setting.

“This a private reflection on issues like your individual functionality to speculate, why you are investing, the technique that you just need to observe, how tolerant you’re to danger in opposition to that technique, how lengthy you need to make investments for, after which the precise targets you are attempting to realize,” he stated.

“For instance, anyone investing over a shorter time period time interval, say three years, can have or ought to have a unique method to somebody investing over, say 30 years. Whereas each ought to be diversified, once more, the precise issues that they put money into, and the chance they take, will possible be completely different over these two completely different time time horizons.

“So when it comes time to speculate, happily immediately, buyers have improbable instruments at their fingertips, which allow them to diversify each rapidly and likewise fairly effectively. Trade traded funds (ETFs) put money into a broad vary of asset sectors in a single buy. There’s by no means been a better time or more economical time for buyers to have the ability to get the advantages of diversification with out having to pick dozens of particular person shares.”

Regardless of a seemingly limitless variety of choices to select from, Mr Wallace stated this will depart buyers with extra questions than solutions.

“The confusion buyers face is that they know they need to put money into ETFs to realize diversification, however there’s so a lot of them both on the US market or the Australian market {that a} paralysis of selection exists.

“I believe for many individuals, that may truly cause them to not even make investments, as a result of they do not perceive what they’re truly doing.

“By means of Syfe’s ‘Good Baskets’ function, customers can can filter primarily based on their very own preferences, time horizon and danger tolerance, targeted on market or revenue or progress, and actually choose the appropriate pre-built bundle of orders for them, which we really feel is sort of highly effective on this age to have a variety of selection.

Mr Wallace stated one other issue to think about as a strong add-on to diversification is constant funding.

“If constant funding is finished frequently, over time, it does allow an investor to make the most of the peaks and troughs that naturally happen available in the market and probably cut back their danger of funding over time,” he stated.

Tricks to get began with micro-investing

That can assist you get began in your micro-investing journey, Mr Wallace outlined just a few tips that could hold entrance of thoughts.

“The very first thing is there’s there’s by no means an ideal time to get into the market. Even the most effective inventory pickers on the earth battle to time this,” he stated.

“What’s most vital for almost all of us is now that you just’re available in the market, you are constant together with your funding, and also you’re true to your funding technique.

“Micro-investing is a very wonderful means for buyers to get began, not solely to be taught and construct confidence, but additionally to speculate at a stage that is snug for their very own circumstances. That stated there is no tried and true definition of micro-investing.

“Investing by and huge is you in the end wanting a platform that allows you to make investments how you want, whether or not that is small and constant or massive and rare. So Syfe was constructed with that in thoughts.

“We needed to scale back these boundaries to entry that a variety of buyers face, together with this notion that you just want some huge cash to begin investing.

“Overwhelming majority of oldsters assume you want like a minimal of $1,000 bucks to get the ball rolling – there’s even a big portion that assume you want a minimal of $10,000 to begin investing.

“Syfe permits buyers to purchase into the US market from as little as $1 and the Aussie market from as little as one share. This, mixed with our low value brokerage is a improbable method for buyers to get began, get constant and construct their wealth long run.”

Commercial

Want someplace to retailer money and earn curiosity? The desk beneath options financial savings accounts with a number of the highest rates of interest available on the market.

- Get a Welcome bonus of $20. Simply make 3 purchases within the 1st 30 days

- Use code: BONUS20

- T&Cs apply

All merchandise with a hyperlink to a product supplier’s web site have a industrial advertising relationship between us and these suppliers. These merchandise could seem prominently and first inside the search tables no matter their attributes and will embrace merchandise marked as promoted, featured or sponsored. The hyperlink to a product supplier’s web site will mean you can get extra data or apply for the product.

By de-selecting “Present on-line companions solely” extra non-commercialised merchandise could also be displayed and re-sorted on the prime of the desk. For extra data on how we’ve chosen these “Sponsored”, “Featured” and “Promoted” merchandise, the merchandise we examine, how we earn a living, and different vital details about our service, please click on right here. Charges right as of Could 8, 2023. View disclaimer.

Photographs equipped.