Why it issues: Samsung this week shared its second quarter earnings report for the three-month interval ending June 30, 2023. Income was down six p.c quarter over quarter – largely as a consequence of a decline in smartphone shipments – and the corporate reported an enormous $3.4 billion working loss, however there’s a glimmer or two of hope on the horizon.

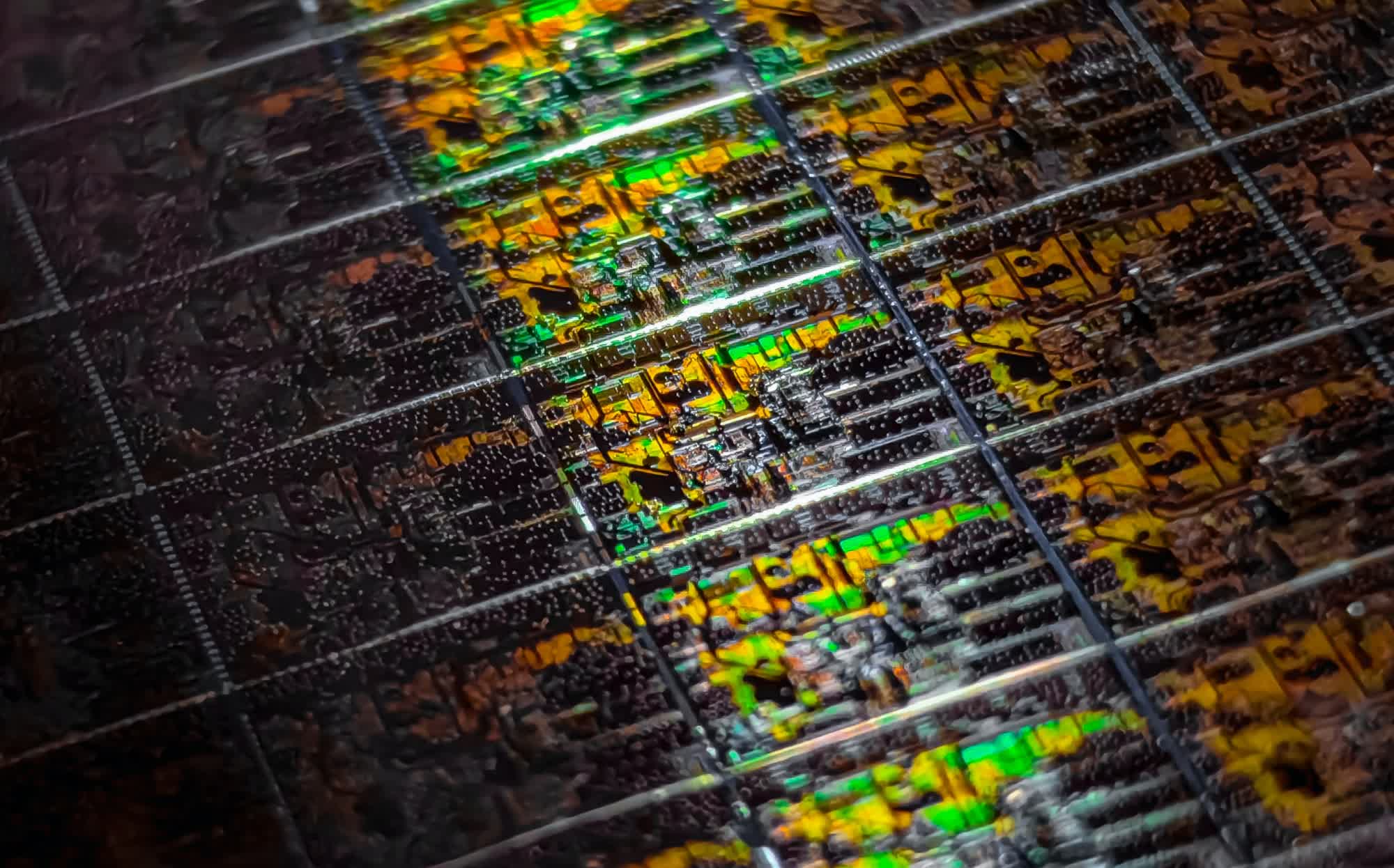

On web page eight of its outcomes and outlook report, Samsung stated mass manufacturing of its third GAA (gate-all-around) product goes easily now that the corporate has stabilized its 3nm course of. Samsung added that it’s growing an improved course of for 3nm based mostly on its mass manufacturing expertise with GAA.

Analysts with market intelligence agency Counterpoint Analysis stated earlier this month that the smartphone business skilled its eight consecutive quarter with a YoY decline in the latest quarter. Reminiscence chip makers have additionally had a tough row to hoe as of late.

TrendForce just lately stated it expects solid-state drive costs to dip an extra 13 p.c within the third quarter. PC DRAM costs, nonetheless, have seemingly hit all-time low. If you’re out there for the latter, now could be nearly as good a time as any to choose up some RAM for subsequent to nothing.

AnandTech famous that Samsung has been utilizing its SF3E node (previously often known as 3GAE, 3nm gate-all-around early) to make chips for devoted cryptocurrency miners for a number of outfits together with MicroBot and PanSemi. A 3rd crypto buyer can be utilizing Samsung’s course of, we perceive, however the Korean tech big didn’t point out any names.

Because the publication highlights, producing chips for crypto miners is a superb method for Samsung to check new fabrication processes in business functions. Even with a comparatively excessive defect price, yields are prone to be ok to be viable for ASICs.

Samsung stated it expects international demand for electronics to steadily recuperate within the second half of this 12 months, resulting in improved earnings from its element enterprise.

Picture credit score: Fidel Fernando, Wu Yi