Perfios, an Indian fintech that gives real-time credit score underwriting options to banks and non-banking monetary establishments, has raised $229 million in a brand new funding spherical because it seems to be deepen its enlargement in North America and Europe.

The 15-year-old startup’s Collection D funding was led by Indian non-public fairness agency Kedaara Capital. The brand new funding included some secondary gross sales, however the startup didn’t specify the quantity. The Bengaluru-headquartered agency, which additionally counts Warburg Pincus and Bessemer Enterprise Companions amongst its backers, has raised $384 million in major and secondary transactions up to now, based on Tracxn.

The additional participation from non-public fairness corporations means that Perfios, which operates in 18 geographies, is at the very least starting to arrange for its preliminary public providing. (PEs are likely to get entangled with startups, at the very least these within the Asia area, two to 3 years earlier than their IPO.) Replace: Perfios stated it’s concentrating on to go public in 18 to 24 months.

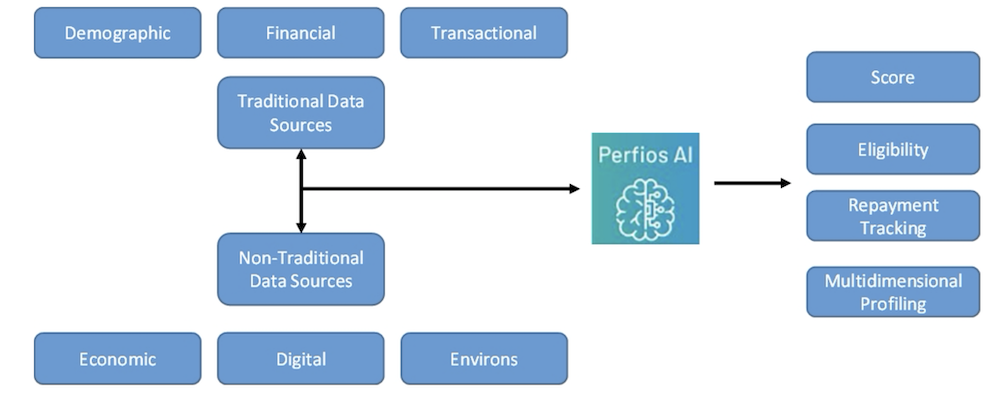

Perfios operates quite a lot of providers that enable companies to automate mortgage selections, provide insights right into a buyer’s monetary worthiness, and mixture information for APIs. It provides each mannequin and mortgage insights, makes use of AI and ML methods, and is tailor-made for varied monetary merchandise.

The platform adapts and learns by itself, and might forecast traits in new markets or areas. With its digital scoring, Perfios AI offers general scores, detailed breakdowns, and options to guage credit score threat effectively, Bernstein analysts stated in a current report.

Perfios’ credit score decisioning instruments (Picture: AllianceBernstein)

“Since our inception in 2008, Perfios has constantly led the best way as a category-creating chief within the SaaS area. I’m stuffed with immense gratitude and pleasure to have led this journey with our 1000+ trusted companions,” stated Sabyasachi Goswami, chief government of Perfios, in a press release.

“This funding will assist us in strengthening the digital transformation journey of our companions, thereby powering monetary inclusion and offering entry to monetary providers to billions throughout the globe.”

Perfios claimed that it’s the market chief in India and has a robust footprint within the Center East and Southeast Asia. “Perfios has created actually the best-in-class fintech SaaS enterprise that performs on the robust secular development and growing digitization ranges within the monetary providers sector in India and globally,” stated Nishant Sharma, founder and managing companion a Kedaara Capital, in a press release.

Perfios’ massive funding comes at a time when most startups globally are struggling to boost new capital as traders turn into cautious of the general public markets situation.

Perfios, an Indian fintech that gives real-time credit score underwriting options to banks and non-banking monetary establishments, has raised $229 million in a brand new funding spherical because it seems to be deepen its enlargement in North America and Europe.

The 15-year-old startup’s Collection D funding was led by Indian non-public fairness agency Kedaara Capital. The brand new funding included some secondary gross sales, however the startup didn’t specify the quantity. The Bengaluru-headquartered agency, which additionally counts Warburg Pincus and Bessemer Enterprise Companions amongst its backers, has raised $384 million in major and secondary transactions up to now, based on Tracxn.

The additional participation from non-public fairness corporations means that Perfios, which operates in 18 geographies, is at the very least starting to arrange for its preliminary public providing. (PEs are likely to get entangled with startups, at the very least these within the Asia area, two to 3 years earlier than their IPO.) Replace: Perfios stated it’s concentrating on to go public in 18 to 24 months.

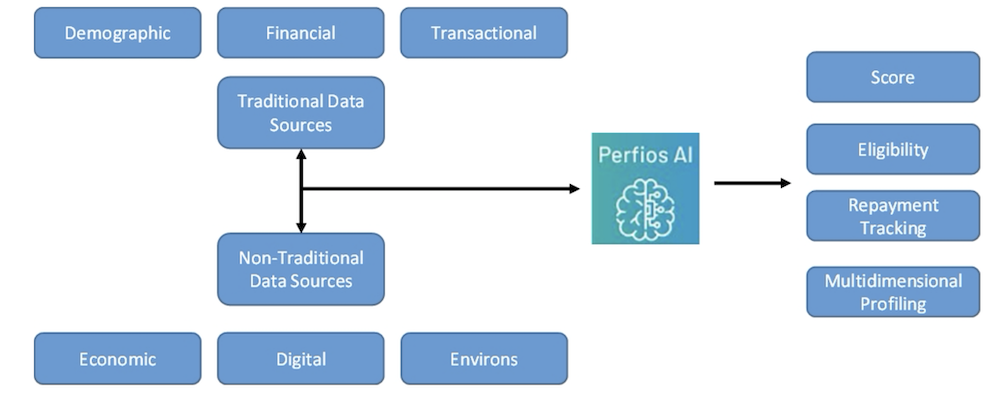

Perfios operates quite a lot of providers that enable companies to automate mortgage selections, provide insights right into a buyer’s monetary worthiness, and mixture information for APIs. It provides each mannequin and mortgage insights, makes use of AI and ML methods, and is tailor-made for varied monetary merchandise.

The platform adapts and learns by itself, and might forecast traits in new markets or areas. With its digital scoring, Perfios AI offers general scores, detailed breakdowns, and options to guage credit score threat effectively, Bernstein analysts stated in a current report.

Perfios’ credit score decisioning instruments (Picture: AllianceBernstein)

“Since our inception in 2008, Perfios has constantly led the best way as a category-creating chief within the SaaS area. I’m stuffed with immense gratitude and pleasure to have led this journey with our 1000+ trusted companions,” stated Sabyasachi Goswami, chief government of Perfios, in a press release.

“This funding will assist us in strengthening the digital transformation journey of our companions, thereby powering monetary inclusion and offering entry to monetary providers to billions throughout the globe.”

Perfios claimed that it’s the market chief in India and has a robust footprint within the Center East and Southeast Asia. “Perfios has created actually the best-in-class fintech SaaS enterprise that performs on the robust secular development and growing digitization ranges within the monetary providers sector in India and globally,” stated Nishant Sharma, founder and managing companion a Kedaara Capital, in a press release.

Perfios’ massive funding comes at a time when most startups globally are struggling to boost new capital as traders turn into cautious of the general public markets situation.