Recap: DoorDash has partnered with Swedish-based monetary providers firm Klarna to supply clients extra methods to pay for deliveries. At checkout, you will have the selection to interrupt a invoice up into 4 equal, interest-free installments, defer a cost till a later date, or pay in full as you usually would.

DoorDash stated the possibility, which is able to launch within the coming months within the US, can be utilized on meals deliveries in addition to groceries, retail purchases, and to pay for a DashPass annual plan.

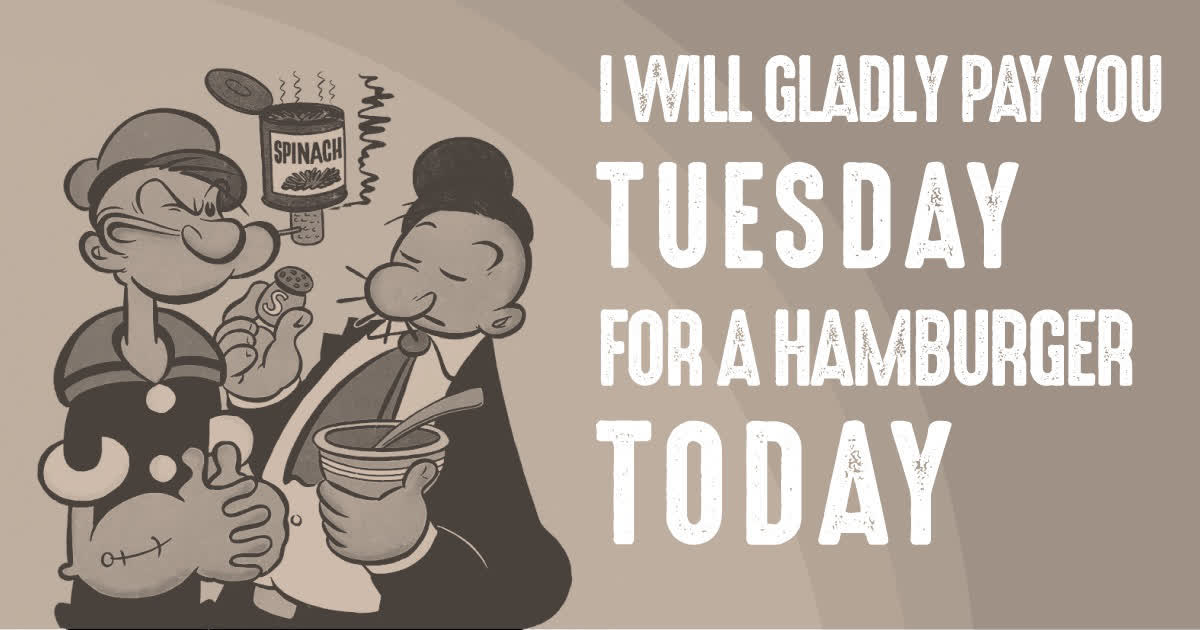

As NBC Information highlights, the announcement has drawn criticism on social media. Of us are usually not terribly upset with DoorDash or Klarna a lot as they’re involved about what the partnership says about our ever-increasing, debt-minded economic system.

what do you imply you’ve gotten $11k in “doordash debt” pic.twitter.com/pu1h8GqdZg

– adam 🇺🇸 (@personofswag) March 20, 2025

A Klarna spokesperson instructed the publication that the characteristic will solely be accessible for DoorDash purchases totaling not less than $35. “Wherever high-cost bank cards are accepted, customers ought to be capable of select a zero-interest credit score product, as an alternative,” the rep added.

Adam Rust, the director of economic providers on the Client Federation of America, instructed NBC Information, “I would not characterize this as an answer. It’s a fintech innovation that creates issues.”

Douglas Boneparth, president of Bone Fide Wealth, shared an analogous sentiment. “Eat now, pay later is an terrible lure. If it’s essential to borrow to have a burrito delivered to you, you’re the product. Nothing extra.”

Klarna is certainly one of a number of purchase now, pay later (BNPL) operations which have emerged over the previous decade or so. Such providers enable customers to make interest-free installment funds on purchases, and make cash by charging charges when clients are late or miss a scheduled cost. Some providers additionally earn income by means of partnerships with retailers.

BNPL is extra standard than ever. Based on Adobe, the choice hit an all-time excessive throughout the 2024 vacation season and was answerable for $18.2 billion in on-line spend.

Client debt continues to be an issue for thousands and thousands of Individuals. Based on the Federal Reserve Financial institution of New York, whole family debt surpassed $18 trillion on the finish of 2024. Sadly, society has normalized debt to the purpose the place few see a difficulty with it… till they can not make their subsequent cost.

A DoorDash spokesperson didn’t touch upon the web criticism the partnership has sparked, however instructed NBC Information that clients can already pay with a wide range of strategies together with CashApp, Venmo, and even with authorities support like SNAP advantages.