The digital financial institution stated the safety management instruments had been the primary of their variety to be launched throughout cell banking.

The options have been designed to stop criminals transferring or withdrawing cash from clients’ accounts, both because of cellphone theft, impersonation scams, or stealing private data.

It comes amid an increase in incidents of cellphone theft over latest years with notably excessive ranges reported in London.

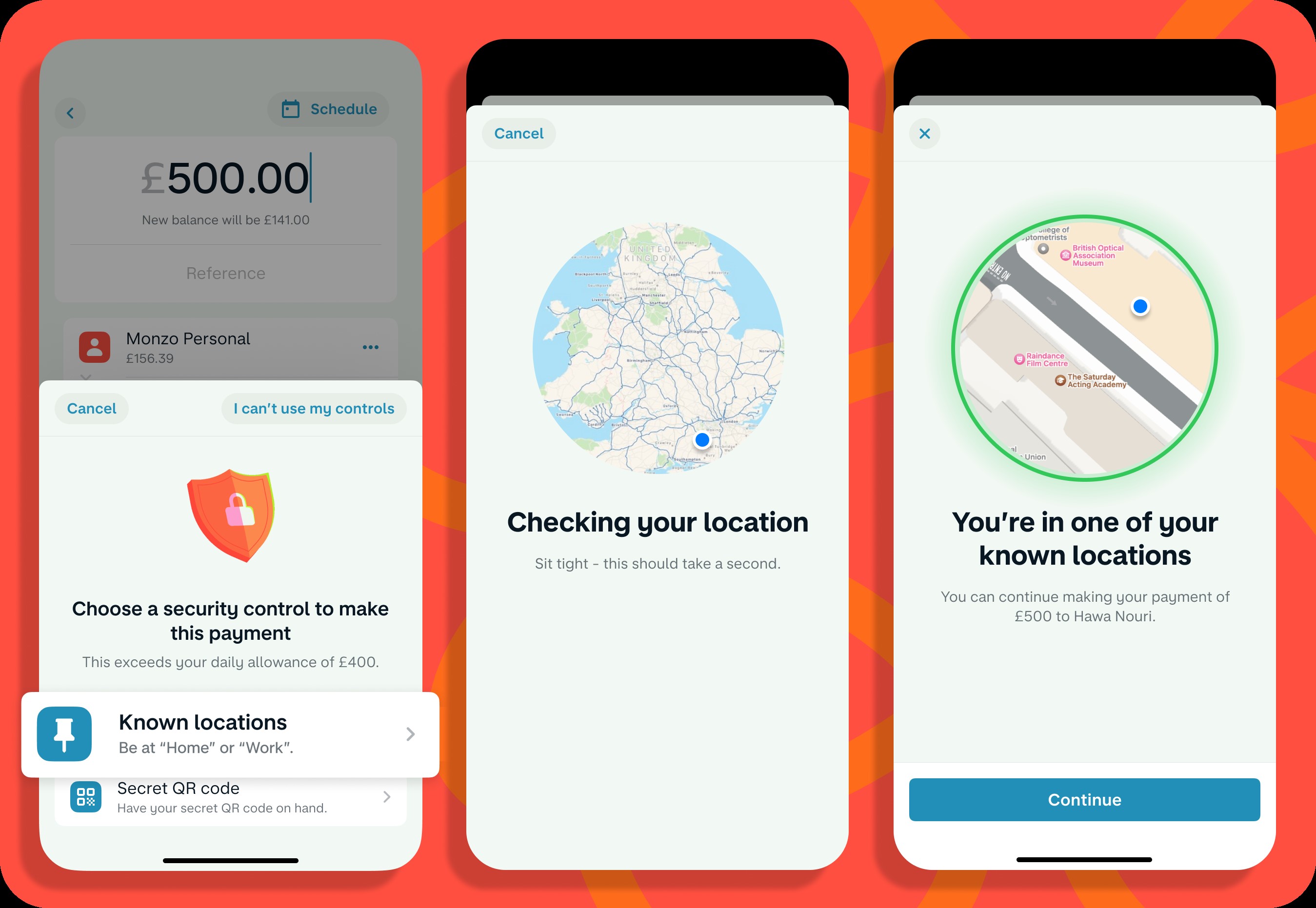

Monzo’s new “recognized areas” function will give clients the choice to decide on a location, like their dwelling or office, that they should be in when transferring cash or withdrawing financial savings over a sure restrict.

Utilizing tracker know-how, the financial institution will establish if their cellphone shouldn’t be in one of many chosen areas and block any tried transactions.

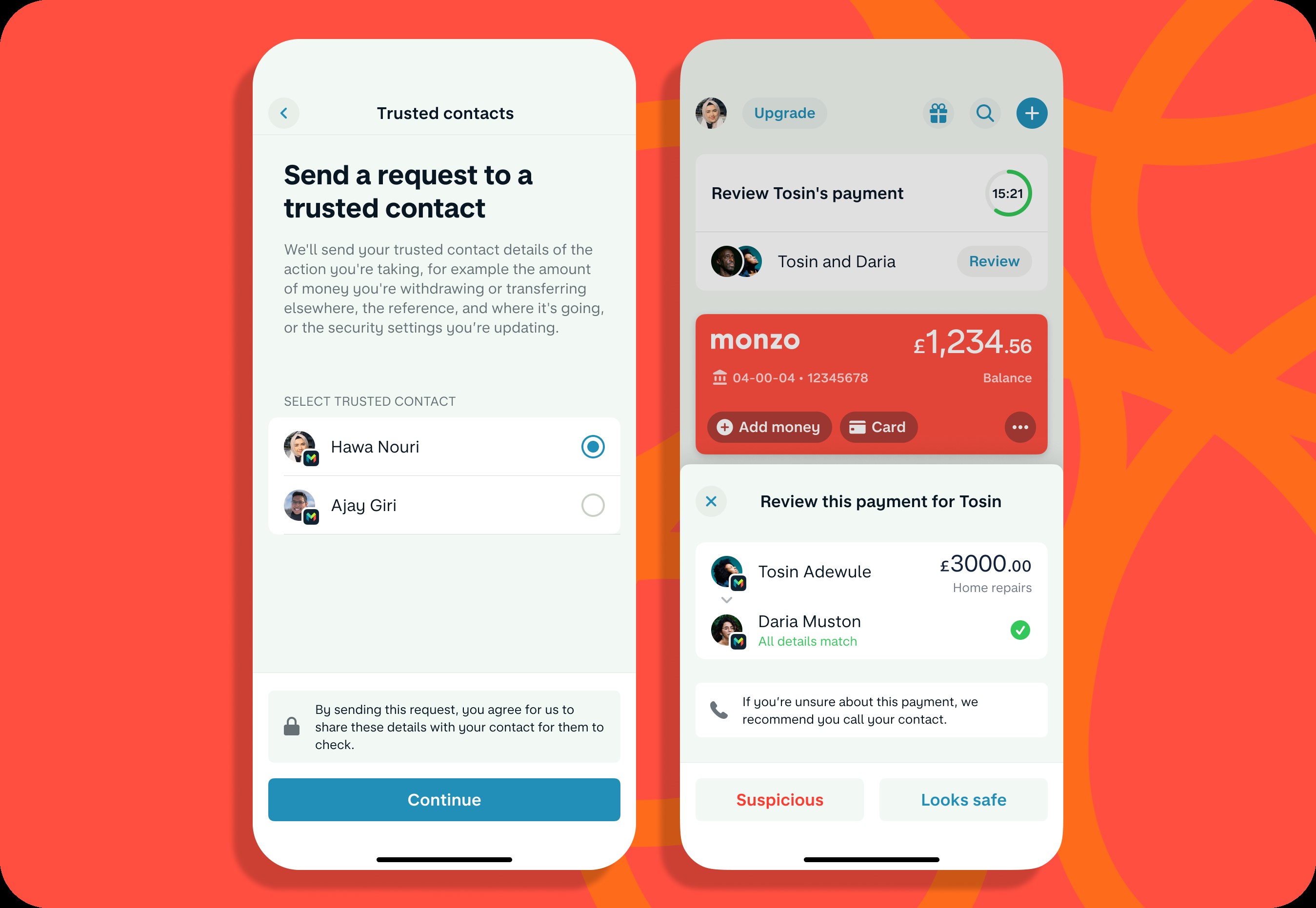

Clients can even select to ask a trusted buddy or member of the family, who additionally has a Monzo account, to be notified earlier than they ship or withdraw cash over a selected restrict.

That particular person can then assessment whether or not they suppose the fee appears protected or is suspicious.

Priyesh Patel, a senior engineer at Monzo, stated the financial institution was attempting to “outpace” the techniques of fraudsters by rolling out new in-app instruments.

He stated: “Whether or not it’s selecting your security radius with recognized areas or having a trusted contact sense-check your funds earlier than you make them, these options supply clients peace of thoughts and drive a much-needed second of pause in a high-stakes scenario.”

The financial institution, which has about 9 million clients, additionally unveiled a 3rd new function whereby clients can select to authenticate a fee by getting a “secret” QR code despatched to a unique gadget.

They then must scan the code by means of their Monzo app for the transaction to undergo.

Mr Patel stated there was “rather more to return” after launching the three new safety controls, which clients must decide in to utilizing.

About 90,000 cellphones, or 250 a day, had been stolen in London in 2022, in line with the most recent statistics from the Met Police.

A separate survey, final month, from cash insights supplier Intuit Credit score Karma discovered that round a tenth of individuals within the UK say they’ve been focused by thieves for his or her telephones up to now 5 years.

In the meantime, the extent of fraud has been spiralling throughout the nation, with banks taking steps to attempt to stop folks dropping their financial savings to scammers.

Commerce physique UK Finance discovered that greater than £1 billion was stolen by criminals by means of unauthorised and authorised fraud final 12 months.