Why it issues: As Intel’s chip design and foundry companies face mounting strain that might jeopardize the corporate’s future, a lot is using on the success of its upcoming 18A node. As Intel finalizes its newest semiconductor course of, 2025 might be a decisive yr for its efforts to legitimize its foundry division and regain competitiveness towards TSMC and Samsung.

Intel has introduced that its 18A course of node is “prepared” for third-party shoppers, with tape-out design finalizations set to start within the first half of this yr. The node is predicted to introduce superior semiconductor options forward of merchandise that includes TSMC’s N2 course of, which is about to debut in 2026.

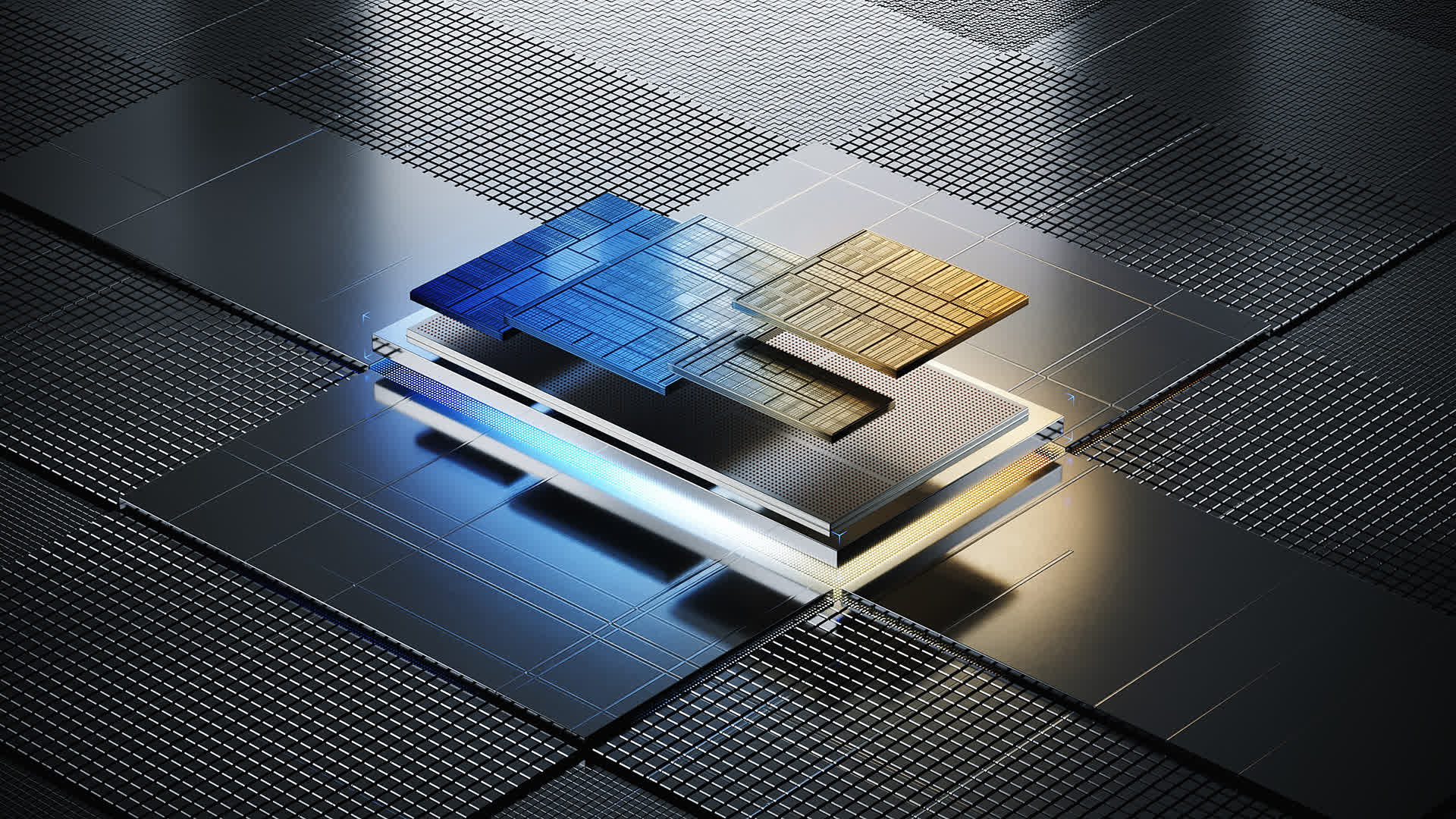

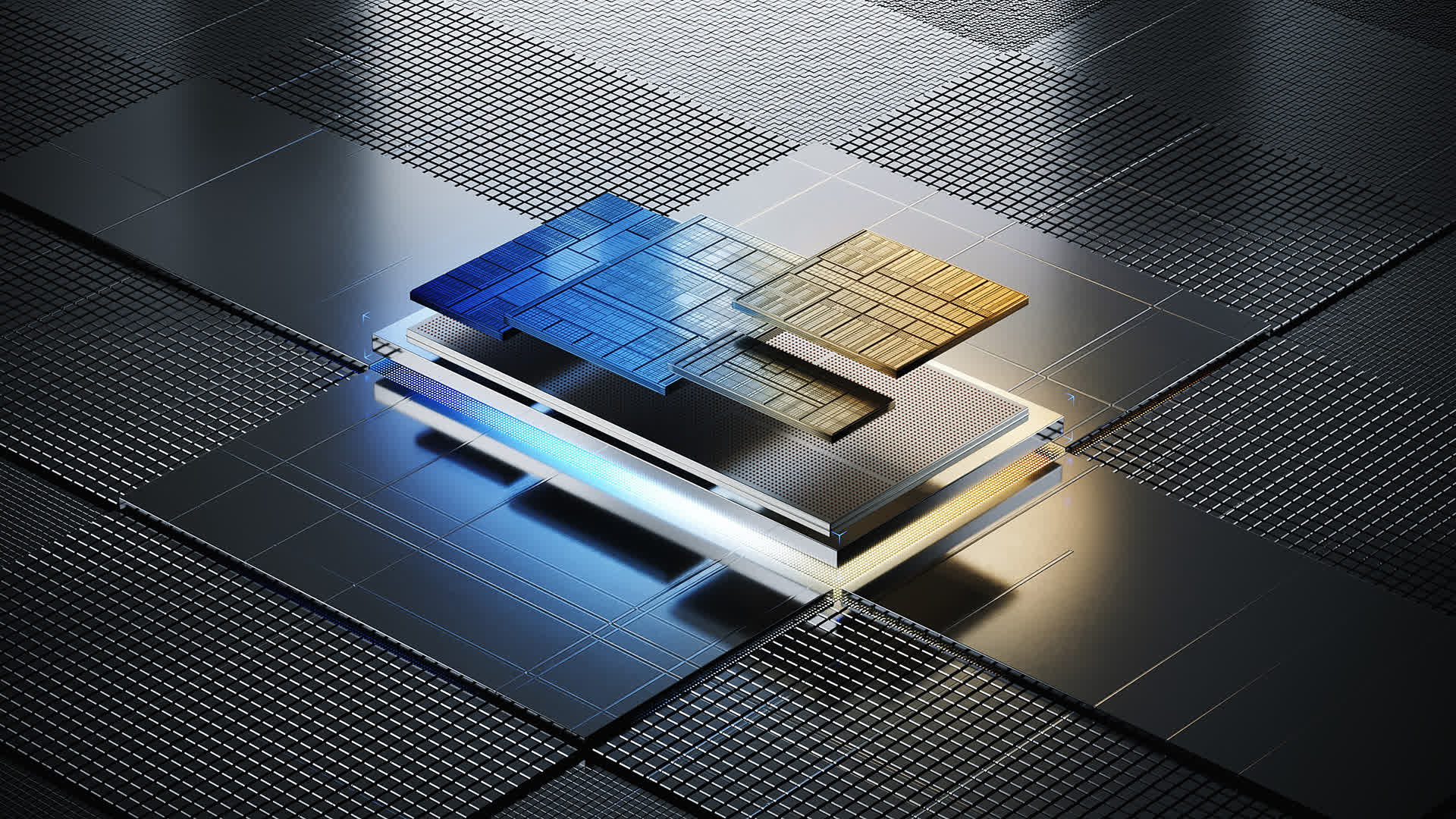

Brief for 18 Angstroms (or 1.8nm), 18A guarantees a 30 % improve in chip density and a 15 % enchancment in efficiency per watt in comparison with Intel 3. The corporate plans to make use of the method for its upcoming Panther Lake laptop computer processors and Clearwater Forest server CPUs, each of that are anticipated to launch earlier than the tip of the yr.

One in all 18A’s most vital improvements is bottom energy supply by PowerVia. By transferring coarse-pitch metals and bumps to the die’s rear and implementing nanoscale through-silicon vias, Intel goals to enhance ISO energy efficiency by 4 % and improve customary cell utilization by 5 to 10 %.

One other key development is RibbonFET, Intel’s tackle gate-all-around transistor expertise. This design permits finer management over electrical currents, decreasing energy leakage – an more and more crucial problem as chips turn out to be smaller and extra densely packed.

TMSC can be readying a gate-all-around structure resolution for its 2nm N2 node, however quantity manufacturing is not anticipated to start till late 2025. The primary client merchandise that includes N2 probably will not arrive till no less than mid-2026, and TSMC plans to implement bottom energy supply with its A16 node that very same yr.

A latest report evaluating 18A and N2 suggests that Intel’s node could provide increased efficiency, whereas TSMC’s achieves higher density. After trailing its opponents for years, Intel has an opportunity of offering semiconductors that might outperform TSMC’s in sure duties and attain the market sooner.

If 18A is profitable, it could present Intel’s foundry enterprise with a much-needed victory amid deep monetary losses that have fueled hypothesis a couple of potential breakup or sale.

The corporate lately reported a staggering $13 billion loss for 2024, whereas TSMC posted an working revenue of $41 billion. Given Intel’s monetary struggles and rising issues over home U.S. chip provides, some have even speculated that TSMC might play a job in stabilizing Intel’s foundries.

Why it issues: As Intel’s chip design and foundry companies face mounting strain that might jeopardize the corporate’s future, a lot is using on the success of its upcoming 18A node. As Intel finalizes its newest semiconductor course of, 2025 might be a decisive yr for its efforts to legitimize its foundry division and regain competitiveness towards TSMC and Samsung.

Intel has introduced that its 18A course of node is “prepared” for third-party shoppers, with tape-out design finalizations set to start within the first half of this yr. The node is predicted to introduce superior semiconductor options forward of merchandise that includes TSMC’s N2 course of, which is about to debut in 2026.

Brief for 18 Angstroms (or 1.8nm), 18A guarantees a 30 % improve in chip density and a 15 % enchancment in efficiency per watt in comparison with Intel 3. The corporate plans to make use of the method for its upcoming Panther Lake laptop computer processors and Clearwater Forest server CPUs, each of that are anticipated to launch earlier than the tip of the yr.

One in all 18A’s most vital improvements is bottom energy supply by PowerVia. By transferring coarse-pitch metals and bumps to the die’s rear and implementing nanoscale through-silicon vias, Intel goals to enhance ISO energy efficiency by 4 % and improve customary cell utilization by 5 to 10 %.

One other key development is RibbonFET, Intel’s tackle gate-all-around transistor expertise. This design permits finer management over electrical currents, decreasing energy leakage – an more and more crucial problem as chips turn out to be smaller and extra densely packed.

TMSC can be readying a gate-all-around structure resolution for its 2nm N2 node, however quantity manufacturing is not anticipated to start till late 2025. The primary client merchandise that includes N2 probably will not arrive till no less than mid-2026, and TSMC plans to implement bottom energy supply with its A16 node that very same yr.

A latest report evaluating 18A and N2 suggests that Intel’s node could provide increased efficiency, whereas TSMC’s achieves higher density. After trailing its opponents for years, Intel has an opportunity of offering semiconductors that might outperform TSMC’s in sure duties and attain the market sooner.

If 18A is profitable, it could present Intel’s foundry enterprise with a much-needed victory amid deep monetary losses that have fueled hypothesis a couple of potential breakup or sale.

The corporate lately reported a staggering $13 billion loss for 2024, whereas TSMC posted an working revenue of $41 billion. Given Intel’s monetary struggles and rising issues over home U.S. chip provides, some have even speculated that TSMC might play a job in stabilizing Intel’s foundries.