Intel has lengthy held a commanding market share lead over AMD, however ever for the reason that launch of first technology Ryzen CPU household in 2017, AMD has slowly been chipping away at Intel’s lead. Except for the disruptions attributable to the pandemic, AMD’s server, cell and desktop gross sales have been on an upward trajectory for a few years, though Intel nonetheless maintains a big lead in all three classes.

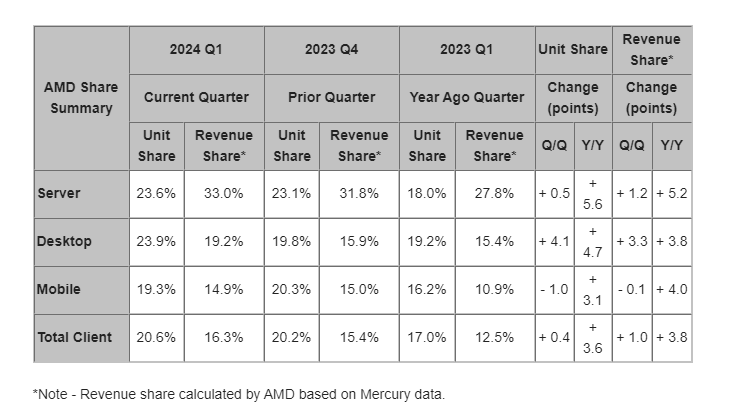

In keeping with a report by Mercury Analysis, and supplied by AMD through e-mail, AMD’s x86 consumer shipments elevated by 3.6% year-on-year, climbing from 17% general, to twenty.6%. That also leaves Intel with a commanding lead, however it would depart the blue firm involved because it struggles to fulfill income expectations.

A break down of the numbers reveals AMD is constant to achieve within the server market, led by robust gross sales of its 4th Gen Epyc processors. AMD gained a powerful 5.6% year-on-year, bringing it to 23.6% of the general server market. Its income share elevated to 33%—an organization file in response to AMD—which signifies gross sales of high-margin merchandise are going very effectively.

Shifting on to the desktop market, AMD picked up 4.7% year-on-year giving it a 23.9% share of the desktop x86 market. Personally I am a bit stunned at that achieve on condition that Ryzen 7000-series processors have been available on the market for effectively over 18 months, though demand for Ryzen 8000-series APUs is unquestionably a contributing issue. AMD’s desktop income share was 19.2%, up from 15.4% in the identical quarter a yr in the past. That is a wholesome enhance of three.8%.

The laptop computer market remains to be a troublesome one to crack. AMD’s unit share elevated from 16.2% in Q1 2023 to 19.3% in Q1 2024. That could be a wholesome achieve, although nonetheless behind the desktop and server market shares. Extra spectacular is AMD’s income share achieve, at 14.9% in comparison with simply 10.9% a yr in the past.

That 19.3% share is definitely a drop in comparison with the This autumn 2023 results of 20.3%, that may be attributed to the ramp up of Intel’s Meteor Lake CPUs, though AMD claimed gross sales of its Ryzen 8040 pocket book chips have doubled over the previous yr.

General, these numbers look good for AMD. Intel will probably be significantly involved over AMDs growing share of the profitable server CPU market. It has few short-term solutions to AMD’s core depend and energy effectivity benefits.

Each corporations will probably be hoping to learn from the fledgling AI PC and laptop computer market over the remainder of 2024. Not that AI hype means all that a lot to players proper now. Our eyes are already trying in direction of AMD’s Zen 5 and Intel’s Arrow Lake CPUs to come back later within the yr. Can AMD steal extra of Intel’s market share? Or is Intel cooking one thing up that can shock everybody? Keep tuned.