Have you ever ever encountered Dave, EarnIn, Brigit, or Chime apps? All these are mortgage software program options. However isn’t it banks that subject loans?

Frankly talking, banks like JPMorgan Chase, Financial institution of America, and Wells Fargo nonetheless have the largest client mortgage volumes. Nonetheless, neobanks, digital banks, and different various suppliers are progressively rising their market share.

For instance, the worth of the Brazilian neobank Nubank has moved from $58 million in 2019 to round $3.2 billion in 2023. The market share of purchase now, pay later platforms, akin to Klarna and Afterpay, has additionally risen everywhere in the world.

Furthermore, in 2024, digital banks issued loans amounting to about $13 trillion, which, though 15 instances lower than the quantity supplied by conventional banks ($200 trillion), can be quite a bit in absolute phrases.

Taking all this under consideration, it turns into clear that growing and having a mortgage software generally is a worthwhile endeavor. However easy methods to construct such a platform to take advantage of out of software program improvement providers?

What Is a Mortgage Cell Software and How Does It Work?

A mortgage app is a cellular software program resolution that makes the lending and borrowing course of doable by enabling customers to use for loans, get cash, and watch their monetary obligations.

In easier phrases, these apps deliver debtors and lenders collectively, who could be people or monetary establishments, and use subtle applied sciences to provoke and ease the appliance course of.

Credit score apps sometimes characteristic easy, user-friendly screens and dashboards that permit debtors to use for loans, add paperwork, and obtain approvals or rejections on-line.

When accredited, funds are deposited into the account of the borrower, and reimbursement circumstances are set. Most often, credit score apps additionally present lenders with mortgage monitoring, threat governance, and portfolio administration.

Market Overview of Mortgage Lending Cell App Improvement

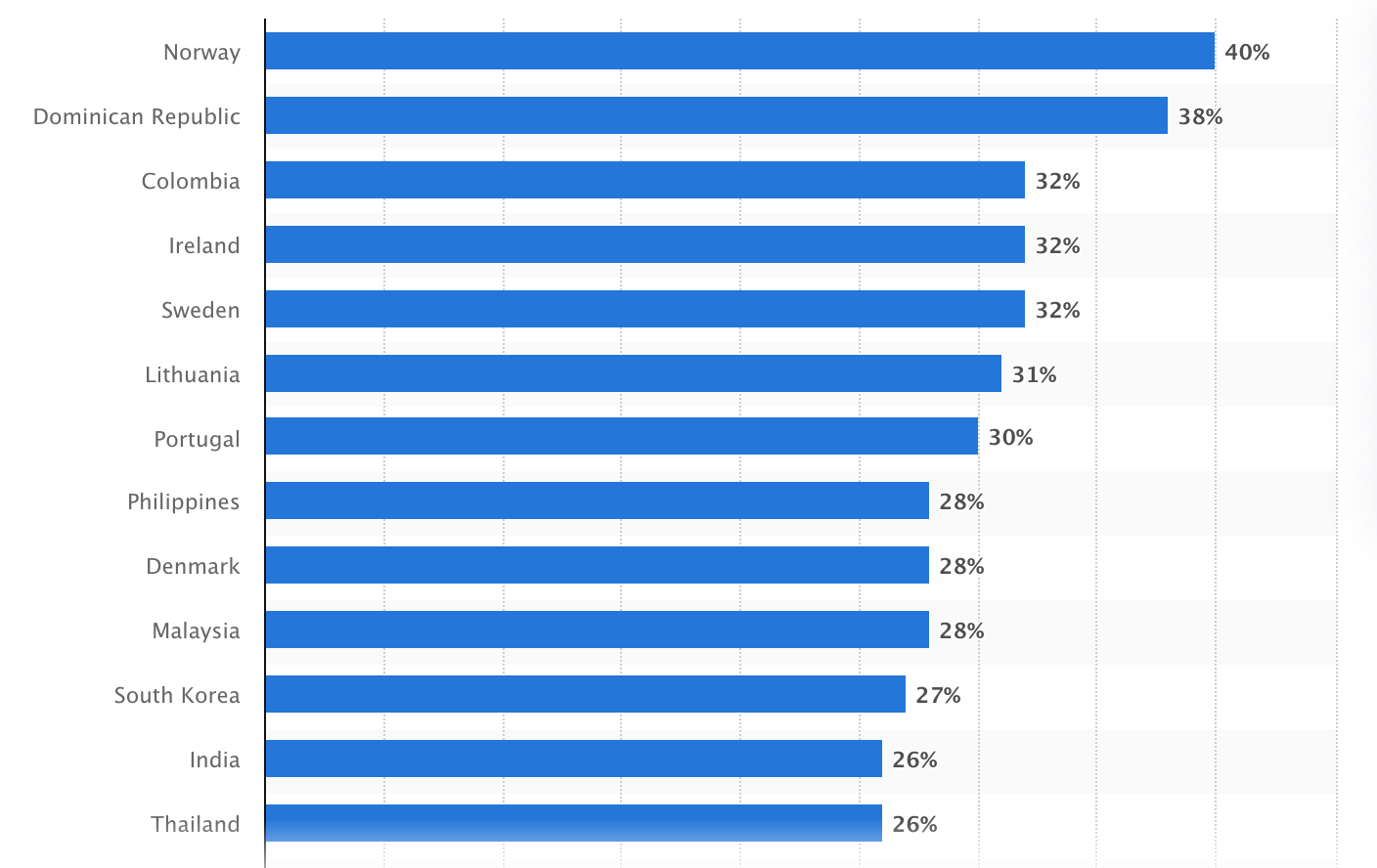

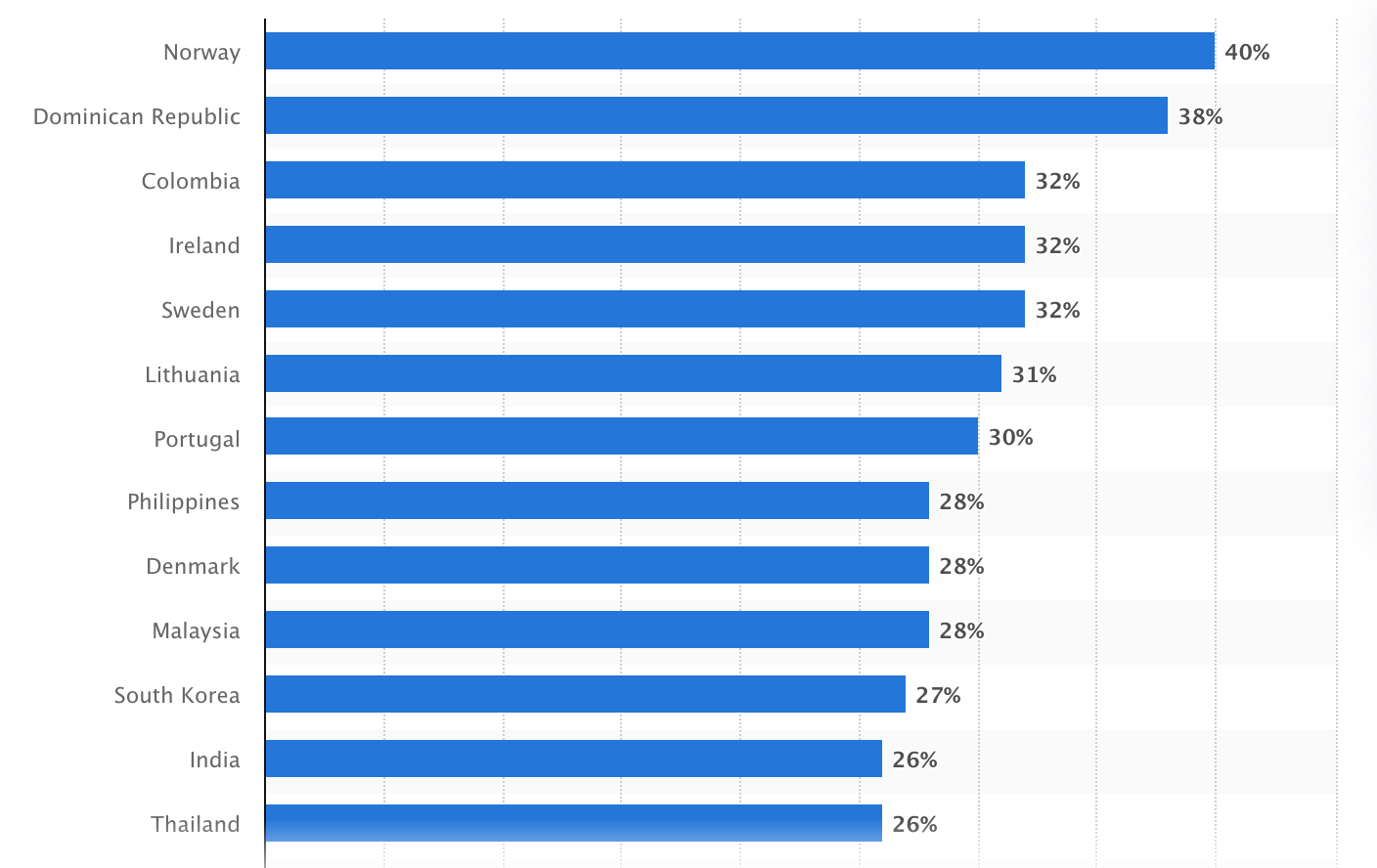

It’s an indisputable fact that society has turn out to be extra consuming. When trying on the credit score homeowners in nations all over the world, it turns into clear that an increasing number of individuals depend on loans to cowl their monetary wants.

In Colombia, this quantity reaches 32%, and within the Dominican Republic 38%. However Norway stays the chief, the place the variety of credit score debtors is 40%. However why do individuals search for alternative routes to get loans?

Share of mortgage homeowners worldwide, as of January 2025, Statista

Conventional banking techniques usually contain prolonged paperwork, bodily transactions, and in depth approval procedures which are not comparable with the fashionable tempo of life.

Cell lending purposes, in flip, present a significantly better equal, the place a lender can take credit score immediately, in some instances even inside minutes.

Plus, they’re usually geared up with machine studying algorithms that quantify creditworthiness utilizing various knowledge, akin to cell phone utilization, spending patterns, and social media posts. This manner, a prolonged credit score historical past test is generally not wanted.

As well as, in keeping with Market Analysis Future, there are a variety of different components that contribute to the expansion of credit score purposes. These embrace:

- Rising smartphone penetration

- Reasonably priced cellular app improvement

- Regulatory help for fintech developments

- The development of peer-to-peer (P2P) lending platforms.

- The emergence of microcredit choices

- The adoption of AI, blockchain, and automation

Varieties of Mortgage Options: Peer-to-Peer, Microloan, and Conventional Apps

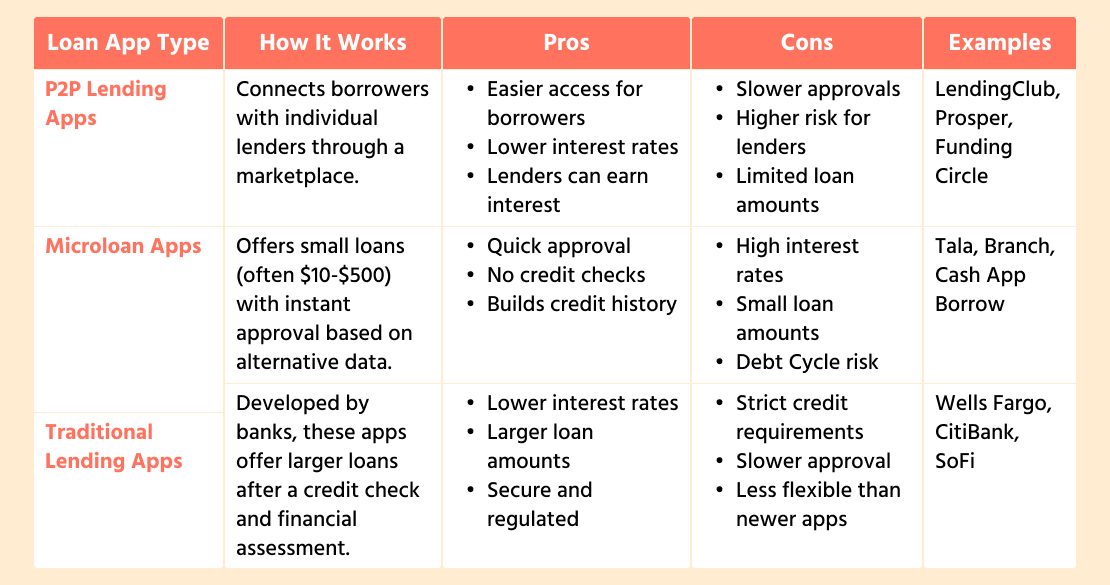

Not all credit score apps are alike. Some join debtors with particular person lenders, some supply tiny, short-term loans, and a few function similar to old-school banks—however all in your cellphone.

Let’s break down the three principal varieties of credit score purposes: peer-to-peer (P2P) lending purposes, microloan instruments, and conventional lending platforms—so you already know what differentiates every.

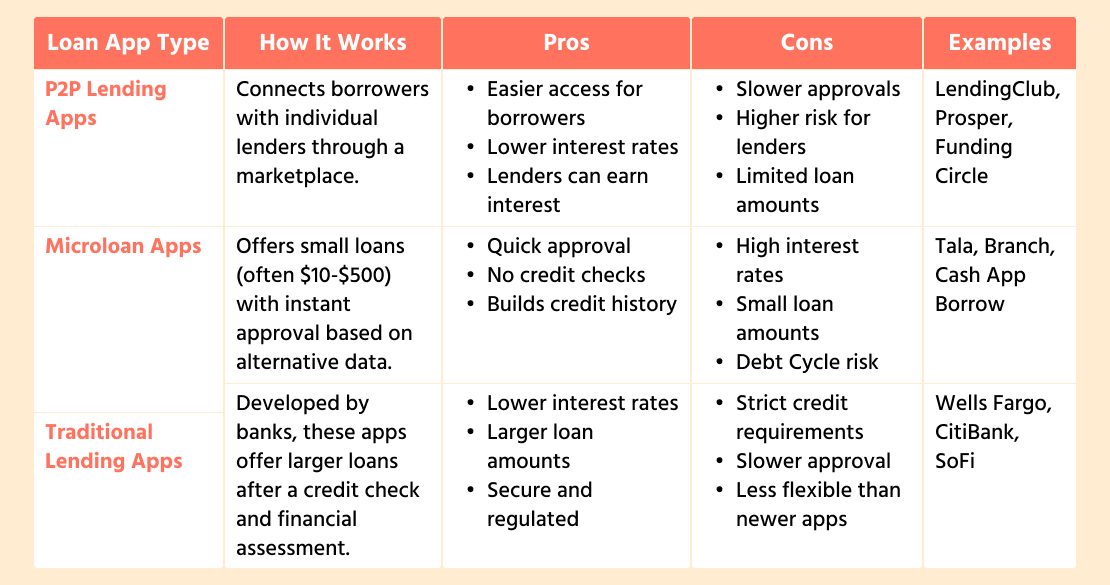

Varieties of Cash Touchdown App Options, Comparative Desk

P2P Lending Apps: Borrow Instantly from Individuals, Not Banks

Peer-to-peer lending instruments function like a market by which one particular person borrows cash from one other particular person versus a financial institution or different monetary establishment.

The app acts because the intermediary that connects lenders with debtors, determines the phrases of agreements, and gives safe transactions.

The way it works:

- Debtors full a type, apply for credit score, and get matched with lenders able to subsidize their requests.

- Lenders select which loans they wish to fund, both manually or by automated techniques that match them with debtors based mostly on threat degree.

- Rates of interest, in flip, are usually set by the platform in keeping with the borrower’s threat rating.

Standard examples: LendingClub, Prosper, Funding Circle

Execs:

- Simpler entry to loans, even for these with restricted credit score historical past.

- Decrease rates of interest in comparison with conventional loans.

- A good way for personal lenders to earn cash when it comes to curiosity.

Cons:

- Not all the time quick—approval of the credit score may take a number of days.

- Better threat to lenders in case the debtors default.

- Credit score quantities could also be smaller than in banks.

Microloan Apps: Small, Quick-Time period Loans for Fundamental Provides

Microloan apps are designed to offer small loans, sometimes for individuals who don’t qualify for normal credit score, akin to individuals in rising economies the place penetration of economic merchandise is low.

Microloan options are completely different from P2P platforms as they’re normally secured by a agency or fintech firm fairly than particular person lenders.

The way it works:

- Customers apply for small quantities (usually between $10 and $500), sometimes for short-term use.

- The app employs AI to scan knowledge and resolve if a borrower is eligible.

- When accredited, the credit score is immediately disbursed, and repayments are scheduled mechanically.

Standard examples: Tala, Department, Money App Borrow

Execs:

- Very quick approvals—some credit are accredited inside minutes.

- No conventional credit score checks are required.

- Helps individuals construct a credit score historical past.

Cons:

- Excessive rates of interest since these are short-term, high-risk loans.

- Debtors can fall right into a debt entice in the event that they don’t plan reimbursement correctly.

- Credit score quantities are restricted, and so they’re not significantly appropriate for giant bills.

Conventional Apps: Banks and Monetary Establishments Go Digital

Banks, credit score unions, or monetary establishments develop conventional platforms to digitalize their mortgage choices. These apps work the identical method as visiting a financial institution to use for a mortgage—solely on-line.

They’re finest for people who find themselves searching for bigger, extra structured loans, akin to private credit, automobile loans, or house mortgages.

The way it works:

- Debtors apply for a mortgage by way of the app.

- The financial institution opinions their monetary standing, revenue, and credit score historical past.

- After approval, the funds are disbursed and fee preparations are made in common (normally month-to-month) installments.

Standard examples: Wells Fargo Private Loans, CitiBank Mortgage Resolution, SoFi

Execs:

- Bigger mortgage quantities can be found.

- Protected and controlled by monetary authorities.

Cons:

- Stringent necessities—debtors should present a constructive credit score historical past and proof of revenue.

- It is going to take longer to qualify than microloan or P2P purposes.

- Much less freedom in comparison with fintech mortgage options.

Which Mortgage Resolution Is Proper for Lending Enterprise?

In case you’re an entrepreneur making a monetary app, what kind you create relies on whom you wish to serve.

If you wish to supply fast, short-term credit to individuals with fewer credit score histories, create a microloan app. If you would like debtors to borrow from individuals as an alternative of banks, a sort is extra applicable.

Nevertheless, if you’re searching for extra substantial financing, like enterprise or private loans, a traditional app is certainly the most suitable choice.

Key Advantages of Cash Lending App Improvement

There are numerous advantages to creating your individual credit score software. For instance, having such an app means you could earn cash in a lot of methods, other than mortgage curiosity. You possibly can take and supply:

- Mortgage charges

- Premium plans

- Late fee charges

- Companion offers

- Adverts contained in the app

The second profit of getting your individual app is you could lower out the intermediary. This implies you don’t need to share your income with banks or different monetary establishments.

Regardless of should you decide to supply peer-to-peer lending, microloans, or customary financing, making your individual app means you may set your phrases, charges of curiosity, and expenses.

The following benefit is you could attain extra individuals given the truth that various suppliers are normally open to a wider viewers and may serve those that have been rejected by conventional establishments.

In contrast to banks, who depend on credit score scores to resolve whether or not to lend to an individual or not, you should use different sources of knowledge to determine if somebody is value lending to.

This offers you the possibility to assist individuals who could not have a recorded credit score historical past however do want entry to cash.

Lastly, while you develop your individual software, you might be utterly free to form it in the way in which that’s most sensible for your small business. Whether or not you deal in private credit, enterprise loans, or providers like Purchase Now, Pay Later (BNPL), you may body an app that might be appropriate in your plans and beliefs.

Stipulations to Begin Cash Lending App Enterprise

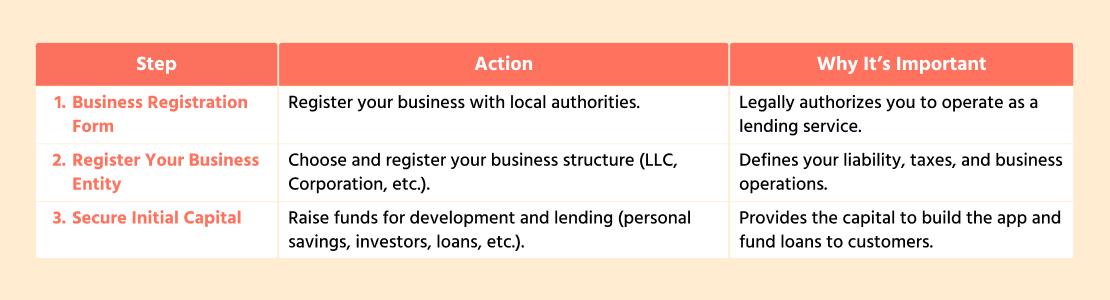

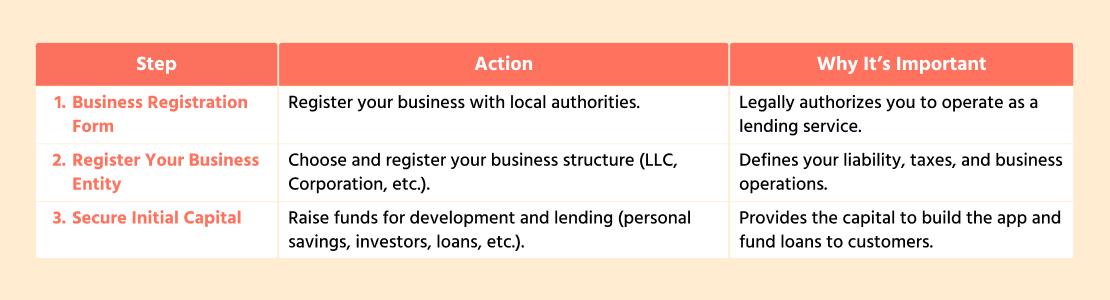

In case you’re planning to create a cash lending resolution, there are a number of essential actions you want to do earlier than you dive into improvement. It’s not all tech—it’s additionally about getting your small business so as.

Stipulations to Think about Earlier than Beginning Cash Lending App Enterprise

Fill Out a Enterprise Licensing Kind

To start with, you want to register your organization. It will take some paperwork along with your state or native authorities in order that they will formally file you as a lending service.

Set Up Your Firm

Subsequent, you’ll need to resolve what kind of enterprise construction is best for you. Are you going to do it alone, or do you want to have a workforce backing you up? Most companies desire a sole proprietorship, an LLC, or an organization, every, nevertheless, with its personal benefits and constraints.

Safe Preliminary Capital

Now, you’ll need to supply some preliminary capital to start out off. Growing an app, sourcing the authorized parts, and operating your small business prices cash.

The quantity will rely upon how giant your app is and what you wish to incorporate. You possibly can fund it from private financial savings, borrow from somebody, get a mortgage, and even get buyers to fund your idea.

In case you’re lending cash, you’ll additionally wish to be sure to have sufficient funds to lend to your clients within the first place.

Steps to Create a Cash Lending App

After all, growing purposes from scratch will not be simple from a technical perspective. On the similar time, should you break the entire course of down into smaller components, at the very least it should turn out to be clear during which path to maneuver:

1. Preliminary Research and Planning

Earlier than you go forward and create the app, it’s essential to do some planning and analysis. It’s essential to know who your app targets, what different apps supply, and easy methods to observe authorized necessities in your space to remain compliant.

On this step, it’s additionally a good suggestion to create a marketing strategy. It is going to allow you to map out how the app will earn cash, the way you’ll promote it, and what assets you’ll want.

2. Listing Main Options

Subsequent, you’ll need to ascertain an important components of your software. Essentially the most important are:

- Mortgage software varieties

- A solution to test customers’ creditworthiness

- A system for approving loans, automated or/and handbook

- A system for fee processing

- Safety features

- A method for customers to trace their repayments

By clarifying these options early on, you’ll know precisely what must be constructed and the way the app will work.

3. Design the Person Interface (UI)

Your app’s UX/UI design actually dictates the way in which individuals will work together with it. In case your app is disorienting or troublesome to make use of, individuals aren’t going to stay round.

Begin with a simple sign-up course of and make it doable for customers to use for loans with out frustration. When signed in, customers ought to have the ability to see a dashboard the place they will see mortgage standing, upcoming funds, and reimbursement historical past.

Be sure that the app is appropriate for telephones in addition to tablets. The design must be crisp, minimal, and user-oriented. So far as colours go, think about blue or inexperienced, that are normally prevalent in finance apps as a result of they confer stability and belief.

3. Select the Proper Expertise

The tech stack has a big position in how the app works and acts. If you’re not a technical specialist and don’t plan to code your self, then at the very least you must resolve on the next factors.

You’ll want to decide on which OS to try for—ought to your app be iOS, Android, or each? With cross-platform frameworks akin to React Native or Flutter, you may lower your self a while and deploy for each.

On the backend, you’ll want a dependable cloud service like AWS or Google Cloud. That is the place all of your knowledge might be saved and processed. You’ll additionally want to select a fee gateway, akin to Stripe or PayPal to direct transactions.

For safety functions, it is very important encrypt the person knowledge and use fraud-prevention software program. The safety of the person knowledge ought to all the time be given the best precedence.

5. Develop the App

Now, it’s time to start out constructing the app. Essentially the most optimum method right here is to rent a improvement workforce that can tackle the frontend (what customers see) and the backend (what’s run within the background) improvement.

They are going to implement all of the options you outlined above, totally take a look at them for bugs, and repair issues prematurely to keep away from bigger issues down the road.

6. Add Safety Measures

As a result of your app goes to cope with delicate monetary info, be sure that to encrypt customers’ knowledge so no person else can entry it.

Implement two-factor authentication (2FA) as nicely, which presents an additional safety layer when individuals log in, and use fraud detection software program to detect suspicious habits earlier than it turns into an issue.

You additionally have to be compliant with trade requirements and laws, together with GDPR (knowledge safety) and PCI DSS (fee card trade knowledge safety customary).

7. Take a look at the App

Earlier than your app sees the world, it’s essential to verify every little thing works as demanded.

It’s essential to test that each one options are functioning correctly, from mortgage purposes to reimbursement monitoring, take a look at the app for efficiency, and look at safety resilience to catch any vulnerabilities.

By absolutely testing the app, you’ll show customers have good reception and that the app is protected to make use of.

8. Announce the App

When the software program is prepared, get able to current it to the market. Right here, you’ll have to elaborate a advertising program to make it identified.

Double-check that your app’s web page is seen to everybody within the Google Play Retailer or App Retailer and is optimized with the appropriate key phrases so individuals can spot it.

9. Watch and Replace

Subsequent, observe the software program’s habits. Notice how the customers reply to it and see what they counsel. In the event that they determine any flaws or counsel new options, tackle these issues.

Replace your app as a way to dispel any doubt, refine present options, and add new ones. Maintain your self conscious of any change in laws and do your utmost to maintain your app legislation-compliant.

Challenges in Mortgage App Improvement and The best way to Overcome Them

How laborious is it to create an app should you by no means handled it earlier than? Frankly talking, like something worthwhile, it comes with its personal hardships. One of many biggest setbacks is matching all financial directives.

In case your software program product doesn’t adhere to financial standards, you could undergo from authorized penalties. To show your progress on this path, you’d higher seek the advice of with a licensed lawyer figuring out all of the nuances of economic providers.

Talking of belief, one other main concern is knowledge security. Since mortgage options cope with confidential person information, they turn out to be engaging prey for cybercriminals and scammers.

A breach of information or any criminal activity can severely hurt the status of your app and even result in huge fines. The safer your app is perceived to be, the extra keen your customers will really feel to share their info.

Subsequent, individuals normally are very suspicious of cash apps. In case your app seems to be beneath the requirements anticipated or shady, they could keep away from it.

One other factor you’ll have to pay shut consideration to is the person expertise (UX). The success of any app relies upon largely on how clear and fulfilling it’s to make use of. If customers discover it bewildering, perplexing, illogical, or gradual, they’ll shortly substitute you.

To verify this doesn’t occur, design your app to be easy but high-quality. The lending course of must be clearly understood and never topic to misinterpretation.

The following problem you’ll come throughout is credit score scoring and assessing threat. Conventional lending techniques depend on credit score scores to price debtors, however what in the event that they don’t have a credit score historical past?

To resolve this, use various credit score scoring fashions that look at customers based mostly on social media exercise, fee historical past, and even behavioral traits just like the frequency of on-time invoice funds.

AI-based credit score scoring software program may also assist price debtors’ creditworthiness, thereby exposing extra customers to your platform.

Lastly, you could discover it laborious to retain customers. It’s not sufficient to get customers to obtain your app; you additionally should maintain them concerned and coming again.

Provide them monitoring of the mortgage, reminders for repayments, and customized presents as a kind of incentive. Common push notifications and loyalty rewards may also keep customers in your software.

But above all, maintain listening to your customers. Their suggestions may also help you polish the app and maintain it relevant.

How A lot Does It Value to Construct a Mortgage App?

When making a mortgage app, entrepreneurs usually ask how a lot all that is going to value. The value all the time relies on many standards, together with how complicated the elements are, whether or not the app goes for one or a number of OS, and whether or not it’s all made in-house or outsourced to a software program improvement firm.

Figuring out the approximate bills can help you in higher allocating your finances. Let’s roughly dissect it:

- Information Assortment and Technique Improvement: $5,000–$10,000

- Design and Prototyping: $10,000–$15,000

- Improvement (Frontend and Backend): $50,000–$150,000+

- High quality Assurance: $5,000–$10,000

- Launch, Advertising and marketing, Gross sales: $10,000–$20,000

Within the preliminary design and planning section, you may count on to pay for market investigation, wireframing, and pilot testing. It will usually take you from $5,000 to $15,000, relying on the extent of element you need in your analysis and the way a lot work the designers must do.

In case you’re creating it for each iPhones and Androids, you’ll be on the upper finish of that vary as a result of it should indicate having to assemble duplicate variations for every platform.

The event half, the place coding and backend work is completed, isn’t any inexpensive. An MVP offering solely the necessities and nothing fancy could be within the spectrum of $30,000 to $50,000.

However when you have ambitions for high-end options, the associated fee can soar a lot greater—$70,000 to $150,000 or extra.

It’s also value mentioning the value of integrating fee gateways and compliance with financial institution laws, which could be within the vary of $10,000 to $20,000.

In addition to, you’ll have to consider lasting expenses for testing, deployment, and maintenance. Testing generally quantities to $5,000-$15,000 once more relying on the complexity.

Deployment expenses lower than the opposite phases, one thing between $1,000 to $5,000. Annual routine updates, gaps and flaws, and safety patches could take you $5,000 to $15,000.

Nevertheless, the upkeep payment can double should you add new options or encounter any drawback requiring emergency care.

The Position of Authorized Compliance and Encryption

The key issues you’ve got to keep in mind all through all the improvement course of are authorized compliance and encryption. Why?

Utilizing end-to-end encryption (the place knowledge is rearranged and solely the meant recipient can unlock it) is important when coping with funds and delicate information. With out sturdy encoding, your customers’ particulars may very well be in danger, and that would result in main irrevocable safety breaches or harm to the general public picture.

Authorized compliance, by and enormous, demonstrates you observe the instructions and laws for lending and supervising monetary particulars within the locations the place your app runs.

Completely different areas have completely different legal guidelines about client safety, knowledge privateness, and anti-money laundering.

For instance, within the US, you need to obey the Truthful Lending Act, and in Europe, the GDPR has strict laws about the way you govern confidential information.

Neglecting these decrees can land you in some severe hassle, together with fines, prohibitions, and even license revocation.

The ICO, for instance, has fined British Airways £20m for a consequential knowledge breach that occurred in 2018, ensuing within the licking of non-public knowledge of over 400,000 individuals, together with fee info, names, and addresses.

Properly-Identified Examples of Cash Lending Apps to Seek advice from When Making Your Personal App

If you’re growing a lending app, it may be actually useful to have a kind of position mannequin you may discuss with. These lending corporations have already tried the waters, so it gained’t be such a nasty concept to encourage or be taught from them to keep away from the identical errors:

LendingClub

LendingClub is a number one peer-to-peer lending label. It permits debtors to attach with particular person buyers who fund their loans. The app presents private loans, enterprise loans, and even auto refinance.

LendingClub’s clear and easy design together with its strong monetary options makes it a great template for a peer-to-peer lending app.

Their glorious file for transparency and favorable mortgage circumstances can yield strong classes in your app, significantly with regard to belief with purchasers and communication.

PaySense

PaySense is a type of money-lending apps specializing in lending private loans to people who could not adhere to the factors for a standard mortgage.

It lends fast, low-value loans with handy reimbursement schedules. One good factor about PaySense is its ease of use—customers can request loans, get accredited inside minutes, and have funds wired into their accounts.

Money App

Though it began out as a cash switch app, Money App now presents an assortment of economic providers, together with immediate loans and the flexibility to purchase and promote shares and Bitcoin.

Money App is a good instance of easy methods to make an entire monetary device in a single spot. If you wish to implement options like simple cash entry or a cellular pockets, the Money App is a good prototype.

SoFi

SoFi is one other big within the on-line lending market. It gives pupil loans, private loans, house loans, and refinancing.

SoFi differs from others in its membership framework, during which debtors obtain entry to premium monetary planning options, profession steering, and even insurance coverage.

All in all, SoFi is a superb customary to observe in establishing a extra profound connection along with your clients than merely lending.

Kiva

Kiva is a non-profit lending platform that facilities round microloans for people in underserved districts.

It’s truly completely different from different lending instruments on the checklist in a method it permits individuals to lend small quantities to entrepreneurs and small enterprise homeowners in growing nations.

In case you think about a extra socially aware strategy or wish to penetrate the peer-to-peer lending market, Kiva gives an attention-grabbing instance to show to.

Affirm

Affirm is a BNPL software that enables shoppers to make a purchase and pay for it in components. The applying is extraordinarily user-oriented, with freedom relating to when and easy methods to make funds.

In case you’re going to offer installment-based loans as a part of your software, Affirm is a good consultant to emulate insofar as making every little thing easy and easy.

FAQ

- How a lot does it value to create a cash lending app?

By and enormous, mortgage lending app improvement relies on how a lot you might be keen to spend. For a easy software program device with little performance, you’ll most likely make investments between $20,000–$50,000. A sophisticated one with credit score scoring powered by AI, automation, and further security mechanisms ranges from $150,000 and above. Design, platform (iOS, Android, or each), and integrations with third events additionally have an effect on the value.

- What options ought to a mortgage app have?

A minimum of, your app ought to embrace person registration, credit score software processing, credit score scoring, monitoring of repayments, fee integrations, and safety mechanisms. To face out, although, add AI for threat inspection, automated approvals, and buyer care chatbots.

- Do I’ve to stick to any authorized laws to start out a credit score app?

Sure! Mortgage purposes contain cash and private knowledge, so you need to adhere to monetary laws. Within the US, as an illustration, you need to adhere to the Truthful Lending Act and California Client Privateness Act. In Europe, you need to abide by GDPR knowledge safety. Overlooking authorized obligations can get your app shut down or fined.

- How do lending apps earn cash?

Nearly all of lending purposes make revenues from curiosity on loans, transaction charges, subscription charges, or commissions from collaborations with banks and lenders. Some additionally supply premium options, akin to monetary planning or early entry to loans, for a payment.

Have you ever ever encountered Dave, EarnIn, Brigit, or Chime apps? All these are mortgage software program options. However isn’t it banks that subject loans?

Frankly talking, banks like JPMorgan Chase, Financial institution of America, and Wells Fargo nonetheless have the largest client mortgage volumes. Nonetheless, neobanks, digital banks, and different various suppliers are progressively rising their market share.

For instance, the worth of the Brazilian neobank Nubank has moved from $58 million in 2019 to round $3.2 billion in 2023. The market share of purchase now, pay later platforms, akin to Klarna and Afterpay, has additionally risen everywhere in the world.

Furthermore, in 2024, digital banks issued loans amounting to about $13 trillion, which, though 15 instances lower than the quantity supplied by conventional banks ($200 trillion), can be quite a bit in absolute phrases.

Taking all this under consideration, it turns into clear that growing and having a mortgage software generally is a worthwhile endeavor. However easy methods to construct such a platform to take advantage of out of software program improvement providers?

What Is a Mortgage Cell Software and How Does It Work?

A mortgage app is a cellular software program resolution that makes the lending and borrowing course of doable by enabling customers to use for loans, get cash, and watch their monetary obligations.

In easier phrases, these apps deliver debtors and lenders collectively, who could be people or monetary establishments, and use subtle applied sciences to provoke and ease the appliance course of.

Credit score apps sometimes characteristic easy, user-friendly screens and dashboards that permit debtors to use for loans, add paperwork, and obtain approvals or rejections on-line.

When accredited, funds are deposited into the account of the borrower, and reimbursement circumstances are set. Most often, credit score apps additionally present lenders with mortgage monitoring, threat governance, and portfolio administration.

Market Overview of Mortgage Lending Cell App Improvement

It’s an indisputable fact that society has turn out to be extra consuming. When trying on the credit score homeowners in nations all over the world, it turns into clear that an increasing number of individuals depend on loans to cowl their monetary wants.

In Colombia, this quantity reaches 32%, and within the Dominican Republic 38%. However Norway stays the chief, the place the variety of credit score debtors is 40%. However why do individuals search for alternative routes to get loans?

Share of mortgage homeowners worldwide, as of January 2025, Statista

Conventional banking techniques usually contain prolonged paperwork, bodily transactions, and in depth approval procedures which are not comparable with the fashionable tempo of life.

Cell lending purposes, in flip, present a significantly better equal, the place a lender can take credit score immediately, in some instances even inside minutes.

Plus, they’re usually geared up with machine studying algorithms that quantify creditworthiness utilizing various knowledge, akin to cell phone utilization, spending patterns, and social media posts. This manner, a prolonged credit score historical past test is generally not wanted.

As well as, in keeping with Market Analysis Future, there are a variety of different components that contribute to the expansion of credit score purposes. These embrace:

- Rising smartphone penetration

- Reasonably priced cellular app improvement

- Regulatory help for fintech developments

- The development of peer-to-peer (P2P) lending platforms.

- The emergence of microcredit choices

- The adoption of AI, blockchain, and automation

Varieties of Mortgage Options: Peer-to-Peer, Microloan, and Conventional Apps

Not all credit score apps are alike. Some join debtors with particular person lenders, some supply tiny, short-term loans, and a few function similar to old-school banks—however all in your cellphone.

Let’s break down the three principal varieties of credit score purposes: peer-to-peer (P2P) lending purposes, microloan instruments, and conventional lending platforms—so you already know what differentiates every.

Varieties of Cash Touchdown App Options, Comparative Desk

P2P Lending Apps: Borrow Instantly from Individuals, Not Banks

Peer-to-peer lending instruments function like a market by which one particular person borrows cash from one other particular person versus a financial institution or different monetary establishment.

The app acts because the intermediary that connects lenders with debtors, determines the phrases of agreements, and gives safe transactions.

The way it works:

- Debtors full a type, apply for credit score, and get matched with lenders able to subsidize their requests.

- Lenders select which loans they wish to fund, both manually or by automated techniques that match them with debtors based mostly on threat degree.

- Rates of interest, in flip, are usually set by the platform in keeping with the borrower’s threat rating.

Standard examples: LendingClub, Prosper, Funding Circle

Execs:

- Simpler entry to loans, even for these with restricted credit score historical past.

- Decrease rates of interest in comparison with conventional loans.

- A good way for personal lenders to earn cash when it comes to curiosity.

Cons:

- Not all the time quick—approval of the credit score may take a number of days.

- Better threat to lenders in case the debtors default.

- Credit score quantities could also be smaller than in banks.

Microloan Apps: Small, Quick-Time period Loans for Fundamental Provides

Microloan apps are designed to offer small loans, sometimes for individuals who don’t qualify for normal credit score, akin to individuals in rising economies the place penetration of economic merchandise is low.

Microloan options are completely different from P2P platforms as they’re normally secured by a agency or fintech firm fairly than particular person lenders.

The way it works:

- Customers apply for small quantities (usually between $10 and $500), sometimes for short-term use.

- The app employs AI to scan knowledge and resolve if a borrower is eligible.

- When accredited, the credit score is immediately disbursed, and repayments are scheduled mechanically.

Standard examples: Tala, Department, Money App Borrow

Execs:

- Very quick approvals—some credit are accredited inside minutes.

- No conventional credit score checks are required.

- Helps individuals construct a credit score historical past.

Cons:

- Excessive rates of interest since these are short-term, high-risk loans.

- Debtors can fall right into a debt entice in the event that they don’t plan reimbursement correctly.

- Credit score quantities are restricted, and so they’re not significantly appropriate for giant bills.

Conventional Apps: Banks and Monetary Establishments Go Digital

Banks, credit score unions, or monetary establishments develop conventional platforms to digitalize their mortgage choices. These apps work the identical method as visiting a financial institution to use for a mortgage—solely on-line.

They’re finest for people who find themselves searching for bigger, extra structured loans, akin to private credit, automobile loans, or house mortgages.

The way it works:

- Debtors apply for a mortgage by way of the app.

- The financial institution opinions their monetary standing, revenue, and credit score historical past.

- After approval, the funds are disbursed and fee preparations are made in common (normally month-to-month) installments.

Standard examples: Wells Fargo Private Loans, CitiBank Mortgage Resolution, SoFi

Execs:

- Bigger mortgage quantities can be found.

- Protected and controlled by monetary authorities.

Cons:

- Stringent necessities—debtors should present a constructive credit score historical past and proof of revenue.

- It is going to take longer to qualify than microloan or P2P purposes.

- Much less freedom in comparison with fintech mortgage options.

Which Mortgage Resolution Is Proper for Lending Enterprise?

In case you’re an entrepreneur making a monetary app, what kind you create relies on whom you wish to serve.

If you wish to supply fast, short-term credit to individuals with fewer credit score histories, create a microloan app. If you would like debtors to borrow from individuals as an alternative of banks, a sort is extra applicable.

Nevertheless, if you’re searching for extra substantial financing, like enterprise or private loans, a traditional app is certainly the most suitable choice.

Key Advantages of Cash Lending App Improvement

There are numerous advantages to creating your individual credit score software. For instance, having such an app means you could earn cash in a lot of methods, other than mortgage curiosity. You possibly can take and supply:

- Mortgage charges

- Premium plans

- Late fee charges

- Companion offers

- Adverts contained in the app

The second profit of getting your individual app is you could lower out the intermediary. This implies you don’t need to share your income with banks or different monetary establishments.

Regardless of should you decide to supply peer-to-peer lending, microloans, or customary financing, making your individual app means you may set your phrases, charges of curiosity, and expenses.

The following benefit is you could attain extra individuals given the truth that various suppliers are normally open to a wider viewers and may serve those that have been rejected by conventional establishments.

In contrast to banks, who depend on credit score scores to resolve whether or not to lend to an individual or not, you should use different sources of knowledge to determine if somebody is value lending to.

This offers you the possibility to assist individuals who could not have a recorded credit score historical past however do want entry to cash.

Lastly, while you develop your individual software, you might be utterly free to form it in the way in which that’s most sensible for your small business. Whether or not you deal in private credit, enterprise loans, or providers like Purchase Now, Pay Later (BNPL), you may body an app that might be appropriate in your plans and beliefs.

Stipulations to Begin Cash Lending App Enterprise

In case you’re planning to create a cash lending resolution, there are a number of essential actions you want to do earlier than you dive into improvement. It’s not all tech—it’s additionally about getting your small business so as.

Stipulations to Think about Earlier than Beginning Cash Lending App Enterprise

Fill Out a Enterprise Licensing Kind

To start with, you want to register your organization. It will take some paperwork along with your state or native authorities in order that they will formally file you as a lending service.

Set Up Your Firm

Subsequent, you’ll need to resolve what kind of enterprise construction is best for you. Are you going to do it alone, or do you want to have a workforce backing you up? Most companies desire a sole proprietorship, an LLC, or an organization, every, nevertheless, with its personal benefits and constraints.

Safe Preliminary Capital

Now, you’ll need to supply some preliminary capital to start out off. Growing an app, sourcing the authorized parts, and operating your small business prices cash.

The quantity will rely upon how giant your app is and what you wish to incorporate. You possibly can fund it from private financial savings, borrow from somebody, get a mortgage, and even get buyers to fund your idea.

In case you’re lending cash, you’ll additionally wish to be sure to have sufficient funds to lend to your clients within the first place.

Steps to Create a Cash Lending App

After all, growing purposes from scratch will not be simple from a technical perspective. On the similar time, should you break the entire course of down into smaller components, at the very least it should turn out to be clear during which path to maneuver:

1. Preliminary Research and Planning

Earlier than you go forward and create the app, it’s essential to do some planning and analysis. It’s essential to know who your app targets, what different apps supply, and easy methods to observe authorized necessities in your space to remain compliant.

On this step, it’s additionally a good suggestion to create a marketing strategy. It is going to allow you to map out how the app will earn cash, the way you’ll promote it, and what assets you’ll want.

2. Listing Main Options

Subsequent, you’ll need to ascertain an important components of your software. Essentially the most important are:

- Mortgage software varieties

- A solution to test customers’ creditworthiness

- A system for approving loans, automated or/and handbook

- A system for fee processing

- Safety features

- A method for customers to trace their repayments

By clarifying these options early on, you’ll know precisely what must be constructed and the way the app will work.

3. Design the Person Interface (UI)

Your app’s UX/UI design actually dictates the way in which individuals will work together with it. In case your app is disorienting or troublesome to make use of, individuals aren’t going to stay round.

Begin with a simple sign-up course of and make it doable for customers to use for loans with out frustration. When signed in, customers ought to have the ability to see a dashboard the place they will see mortgage standing, upcoming funds, and reimbursement historical past.

Be sure that the app is appropriate for telephones in addition to tablets. The design must be crisp, minimal, and user-oriented. So far as colours go, think about blue or inexperienced, that are normally prevalent in finance apps as a result of they confer stability and belief.

3. Select the Proper Expertise

The tech stack has a big position in how the app works and acts. If you’re not a technical specialist and don’t plan to code your self, then at the very least you must resolve on the next factors.

You’ll want to decide on which OS to try for—ought to your app be iOS, Android, or each? With cross-platform frameworks akin to React Native or Flutter, you may lower your self a while and deploy for each.

On the backend, you’ll want a dependable cloud service like AWS or Google Cloud. That is the place all of your knowledge might be saved and processed. You’ll additionally want to select a fee gateway, akin to Stripe or PayPal to direct transactions.

For safety functions, it is very important encrypt the person knowledge and use fraud-prevention software program. The safety of the person knowledge ought to all the time be given the best precedence.

5. Develop the App

Now, it’s time to start out constructing the app. Essentially the most optimum method right here is to rent a improvement workforce that can tackle the frontend (what customers see) and the backend (what’s run within the background) improvement.

They are going to implement all of the options you outlined above, totally take a look at them for bugs, and repair issues prematurely to keep away from bigger issues down the road.

6. Add Safety Measures

As a result of your app goes to cope with delicate monetary info, be sure that to encrypt customers’ knowledge so no person else can entry it.

Implement two-factor authentication (2FA) as nicely, which presents an additional safety layer when individuals log in, and use fraud detection software program to detect suspicious habits earlier than it turns into an issue.

You additionally have to be compliant with trade requirements and laws, together with GDPR (knowledge safety) and PCI DSS (fee card trade knowledge safety customary).

7. Take a look at the App

Earlier than your app sees the world, it’s essential to verify every little thing works as demanded.

It’s essential to test that each one options are functioning correctly, from mortgage purposes to reimbursement monitoring, take a look at the app for efficiency, and look at safety resilience to catch any vulnerabilities.

By absolutely testing the app, you’ll show customers have good reception and that the app is protected to make use of.

8. Announce the App

When the software program is prepared, get able to current it to the market. Right here, you’ll have to elaborate a advertising program to make it identified.

Double-check that your app’s web page is seen to everybody within the Google Play Retailer or App Retailer and is optimized with the appropriate key phrases so individuals can spot it.

9. Watch and Replace

Subsequent, observe the software program’s habits. Notice how the customers reply to it and see what they counsel. In the event that they determine any flaws or counsel new options, tackle these issues.

Replace your app as a way to dispel any doubt, refine present options, and add new ones. Maintain your self conscious of any change in laws and do your utmost to maintain your app legislation-compliant.

Challenges in Mortgage App Improvement and The best way to Overcome Them

How laborious is it to create an app should you by no means handled it earlier than? Frankly talking, like something worthwhile, it comes with its personal hardships. One of many biggest setbacks is matching all financial directives.

In case your software program product doesn’t adhere to financial standards, you could undergo from authorized penalties. To show your progress on this path, you’d higher seek the advice of with a licensed lawyer figuring out all of the nuances of economic providers.

Talking of belief, one other main concern is knowledge security. Since mortgage options cope with confidential person information, they turn out to be engaging prey for cybercriminals and scammers.

A breach of information or any criminal activity can severely hurt the status of your app and even result in huge fines. The safer your app is perceived to be, the extra keen your customers will really feel to share their info.

Subsequent, individuals normally are very suspicious of cash apps. In case your app seems to be beneath the requirements anticipated or shady, they could keep away from it.

One other factor you’ll have to pay shut consideration to is the person expertise (UX). The success of any app relies upon largely on how clear and fulfilling it’s to make use of. If customers discover it bewildering, perplexing, illogical, or gradual, they’ll shortly substitute you.

To verify this doesn’t occur, design your app to be easy but high-quality. The lending course of must be clearly understood and never topic to misinterpretation.

The following problem you’ll come throughout is credit score scoring and assessing threat. Conventional lending techniques depend on credit score scores to price debtors, however what in the event that they don’t have a credit score historical past?

To resolve this, use various credit score scoring fashions that look at customers based mostly on social media exercise, fee historical past, and even behavioral traits just like the frequency of on-time invoice funds.

AI-based credit score scoring software program may also assist price debtors’ creditworthiness, thereby exposing extra customers to your platform.

Lastly, you could discover it laborious to retain customers. It’s not sufficient to get customers to obtain your app; you additionally should maintain them concerned and coming again.

Provide them monitoring of the mortgage, reminders for repayments, and customized presents as a kind of incentive. Common push notifications and loyalty rewards may also keep customers in your software.

But above all, maintain listening to your customers. Their suggestions may also help you polish the app and maintain it relevant.

How A lot Does It Value to Construct a Mortgage App?

When making a mortgage app, entrepreneurs usually ask how a lot all that is going to value. The value all the time relies on many standards, together with how complicated the elements are, whether or not the app goes for one or a number of OS, and whether or not it’s all made in-house or outsourced to a software program improvement firm.

Figuring out the approximate bills can help you in higher allocating your finances. Let’s roughly dissect it:

- Information Assortment and Technique Improvement: $5,000–$10,000

- Design and Prototyping: $10,000–$15,000

- Improvement (Frontend and Backend): $50,000–$150,000+

- High quality Assurance: $5,000–$10,000

- Launch, Advertising and marketing, Gross sales: $10,000–$20,000

Within the preliminary design and planning section, you may count on to pay for market investigation, wireframing, and pilot testing. It will usually take you from $5,000 to $15,000, relying on the extent of element you need in your analysis and the way a lot work the designers must do.

In case you’re creating it for each iPhones and Androids, you’ll be on the upper finish of that vary as a result of it should indicate having to assemble duplicate variations for every platform.

The event half, the place coding and backend work is completed, isn’t any inexpensive. An MVP offering solely the necessities and nothing fancy could be within the spectrum of $30,000 to $50,000.

However when you have ambitions for high-end options, the associated fee can soar a lot greater—$70,000 to $150,000 or extra.

It’s also value mentioning the value of integrating fee gateways and compliance with financial institution laws, which could be within the vary of $10,000 to $20,000.

In addition to, you’ll have to consider lasting expenses for testing, deployment, and maintenance. Testing generally quantities to $5,000-$15,000 once more relying on the complexity.

Deployment expenses lower than the opposite phases, one thing between $1,000 to $5,000. Annual routine updates, gaps and flaws, and safety patches could take you $5,000 to $15,000.

Nevertheless, the upkeep payment can double should you add new options or encounter any drawback requiring emergency care.

The Position of Authorized Compliance and Encryption

The key issues you’ve got to keep in mind all through all the improvement course of are authorized compliance and encryption. Why?

Utilizing end-to-end encryption (the place knowledge is rearranged and solely the meant recipient can unlock it) is important when coping with funds and delicate information. With out sturdy encoding, your customers’ particulars may very well be in danger, and that would result in main irrevocable safety breaches or harm to the general public picture.

Authorized compliance, by and enormous, demonstrates you observe the instructions and laws for lending and supervising monetary particulars within the locations the place your app runs.

Completely different areas have completely different legal guidelines about client safety, knowledge privateness, and anti-money laundering.

For instance, within the US, you need to obey the Truthful Lending Act, and in Europe, the GDPR has strict laws about the way you govern confidential information.

Neglecting these decrees can land you in some severe hassle, together with fines, prohibitions, and even license revocation.

The ICO, for instance, has fined British Airways £20m for a consequential knowledge breach that occurred in 2018, ensuing within the licking of non-public knowledge of over 400,000 individuals, together with fee info, names, and addresses.

Properly-Identified Examples of Cash Lending Apps to Seek advice from When Making Your Personal App

If you’re growing a lending app, it may be actually useful to have a kind of position mannequin you may discuss with. These lending corporations have already tried the waters, so it gained’t be such a nasty concept to encourage or be taught from them to keep away from the identical errors:

LendingClub

LendingClub is a number one peer-to-peer lending label. It permits debtors to attach with particular person buyers who fund their loans. The app presents private loans, enterprise loans, and even auto refinance.

LendingClub’s clear and easy design together with its strong monetary options makes it a great template for a peer-to-peer lending app.

Their glorious file for transparency and favorable mortgage circumstances can yield strong classes in your app, significantly with regard to belief with purchasers and communication.

PaySense

PaySense is a type of money-lending apps specializing in lending private loans to people who could not adhere to the factors for a standard mortgage.

It lends fast, low-value loans with handy reimbursement schedules. One good factor about PaySense is its ease of use—customers can request loans, get accredited inside minutes, and have funds wired into their accounts.

Money App

Though it began out as a cash switch app, Money App now presents an assortment of economic providers, together with immediate loans and the flexibility to purchase and promote shares and Bitcoin.

Money App is a good instance of easy methods to make an entire monetary device in a single spot. If you wish to implement options like simple cash entry or a cellular pockets, the Money App is a good prototype.

SoFi

SoFi is one other big within the on-line lending market. It gives pupil loans, private loans, house loans, and refinancing.

SoFi differs from others in its membership framework, during which debtors obtain entry to premium monetary planning options, profession steering, and even insurance coverage.

All in all, SoFi is a superb customary to observe in establishing a extra profound connection along with your clients than merely lending.

Kiva

Kiva is a non-profit lending platform that facilities round microloans for people in underserved districts.

It’s truly completely different from different lending instruments on the checklist in a method it permits individuals to lend small quantities to entrepreneurs and small enterprise homeowners in growing nations.

In case you think about a extra socially aware strategy or wish to penetrate the peer-to-peer lending market, Kiva gives an attention-grabbing instance to show to.

Affirm

Affirm is a BNPL software that enables shoppers to make a purchase and pay for it in components. The applying is extraordinarily user-oriented, with freedom relating to when and easy methods to make funds.

In case you’re going to offer installment-based loans as a part of your software, Affirm is a good consultant to emulate insofar as making every little thing easy and easy.

FAQ

- How a lot does it value to create a cash lending app?

By and enormous, mortgage lending app improvement relies on how a lot you might be keen to spend. For a easy software program device with little performance, you’ll most likely make investments between $20,000–$50,000. A sophisticated one with credit score scoring powered by AI, automation, and further security mechanisms ranges from $150,000 and above. Design, platform (iOS, Android, or each), and integrations with third events additionally have an effect on the value.

- What options ought to a mortgage app have?

A minimum of, your app ought to embrace person registration, credit score software processing, credit score scoring, monitoring of repayments, fee integrations, and safety mechanisms. To face out, although, add AI for threat inspection, automated approvals, and buyer care chatbots.

- Do I’ve to stick to any authorized laws to start out a credit score app?

Sure! Mortgage purposes contain cash and private knowledge, so you need to adhere to monetary laws. Within the US, as an illustration, you need to adhere to the Truthful Lending Act and California Client Privateness Act. In Europe, you need to abide by GDPR knowledge safety. Overlooking authorized obligations can get your app shut down or fined.

- How do lending apps earn cash?

Nearly all of lending purposes make revenues from curiosity on loans, transaction charges, subscription charges, or commissions from collaborations with banks and lenders. Some additionally supply premium options, akin to monetary planning or early entry to loans, for a payment.