This transfer caters to a rising development amongst youthful customers preferring various cost strategies over conventional bank cards. Money App Pay joins the prevailing lineup of cost choices within the Play Retailer, which incorporates credit score/debit playing cards, Google Play Credit score, and PayPal (added in 2014).

“We’re repeatedly increasing cost choices on Google Play, and including Money App Pay is a big step in giving customers extra alternative and comfort whereas assembly their evolving cost preferences,” mentioned Pete Albers, Director, Google Play Retail & Funds Activation.

“Subsequent-generation consumers are demanding extra decisions at checkout, and we all know they’re additionally in search of extra methods to pay with their very own cash. This partnership not solely empowers them to pay flexibly for the issues they need, but it surely additionally marries two robust buyer units and maximizes their cell utility,” mentioned Tanuj Parikh, Head of Partnerships, Money App, and Afterpay at Block.

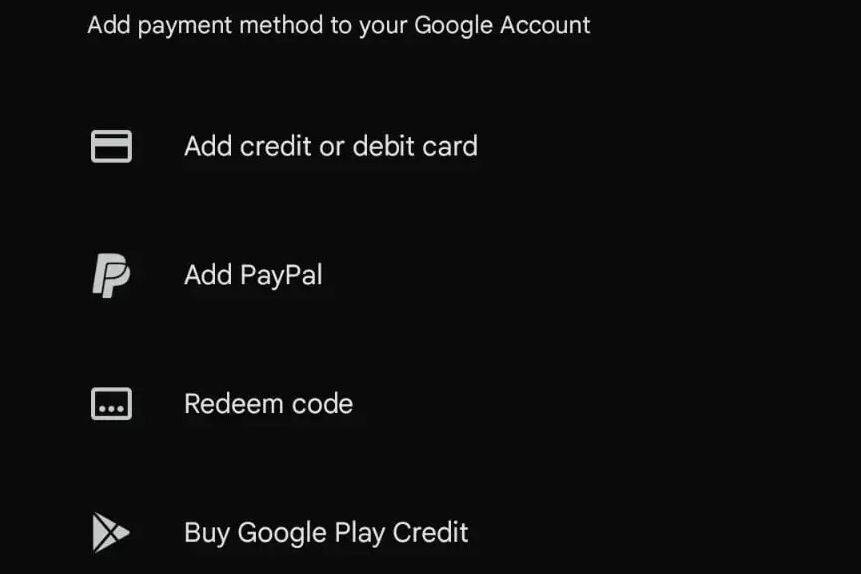

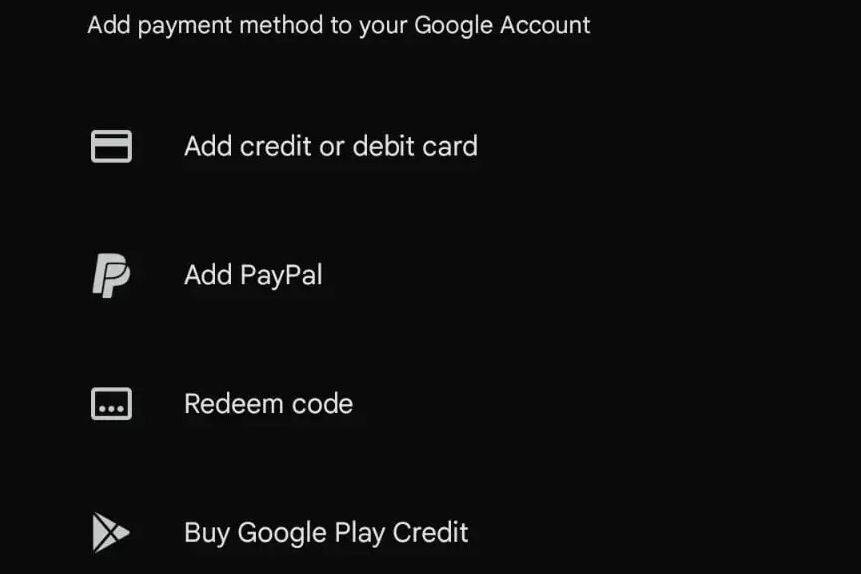

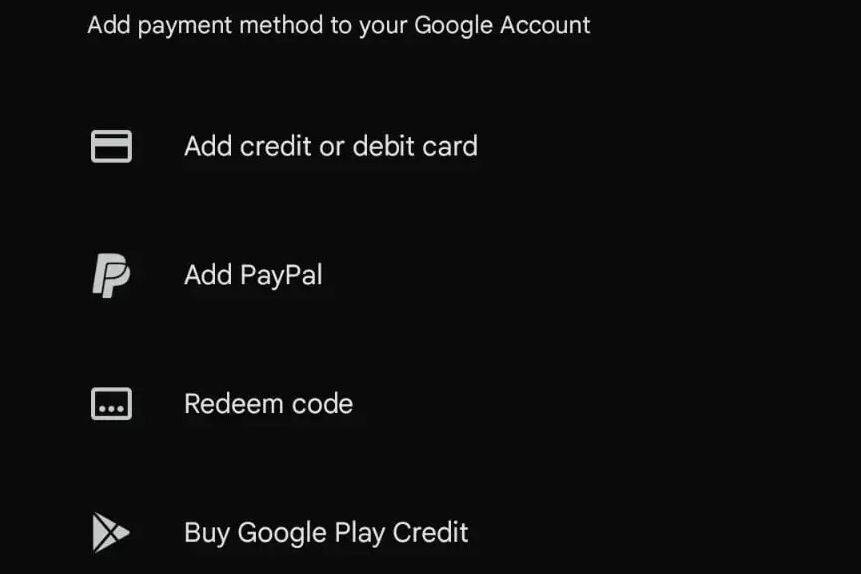

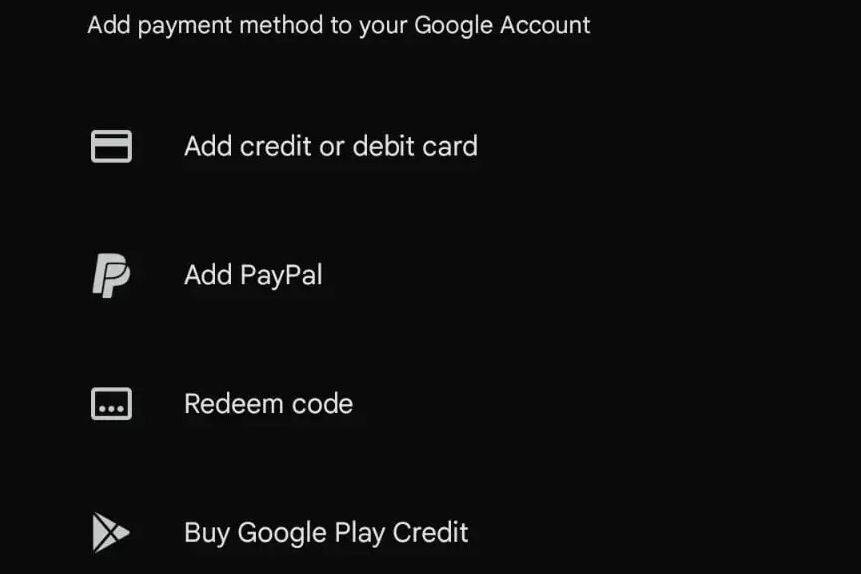

The brand new Money App choice will present up right here, as soon as it is accessible

The function shouldn’t be dwell but, however setting it up can be simple as soon as it’s accessible. You can entry it by following a number of easy steps:

- Faucet your profile image within the prime proper nook of the Play Retailer app.

- Go to “Funds & Subscriptions”

- Choose “Cost Strategies”

- Search for Money App Pay when it turns into accessible

This replace supplies Android customers with better flexibility and comfort when buying digital content material on the Google Play Retailer. The official launch date is coming quickly, so keep tuned, as we are going to replace this text and embody a brief take a look at run of the brand new function when it launches.

This transfer caters to a rising development amongst youthful customers preferring various cost strategies over conventional bank cards. Money App Pay joins the prevailing lineup of cost choices within the Play Retailer, which incorporates credit score/debit playing cards, Google Play Credit score, and PayPal (added in 2014).

“We’re repeatedly increasing cost choices on Google Play, and including Money App Pay is a big step in giving customers extra alternative and comfort whereas assembly their evolving cost preferences,” mentioned Pete Albers, Director, Google Play Retail & Funds Activation.

“Subsequent-generation consumers are demanding extra decisions at checkout, and we all know they’re additionally in search of extra methods to pay with their very own cash. This partnership not solely empowers them to pay flexibly for the issues they need, but it surely additionally marries two robust buyer units and maximizes their cell utility,” mentioned Tanuj Parikh, Head of Partnerships, Money App, and Afterpay at Block.

The brand new Money App choice will present up right here, as soon as it is accessible

The function shouldn’t be dwell but, however setting it up can be simple as soon as it’s accessible. You can entry it by following a number of easy steps:

- Faucet your profile image within the prime proper nook of the Play Retailer app.

- Go to “Funds & Subscriptions”

- Choose “Cost Strategies”

- Search for Money App Pay when it turns into accessible

This replace supplies Android customers with better flexibility and comfort when buying digital content material on the Google Play Retailer. The official launch date is coming quickly, so keep tuned, as we are going to replace this text and embody a brief take a look at run of the brand new function when it launches.