What traits ought to we search for it we need to establish shares that may multiply in worth over the long run? Ideally, a enterprise will present two traits; firstly a rising return on capital employed (ROCE) and secondly, an rising quantity of capital employed. Mainly which means that an organization has worthwhile initiatives that it could actually proceed to reinvest in, which is a trait of a compounding machine. Though, once we checked out Shanghai Newtouch Software program (SHSE:688590), it did not appear to tick all of those bins.

Understanding Return On Capital Employed (ROCE)

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. The method for this calculation on Shanghai Newtouch Software program is:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Property – Present Liabilities)

0.043 = CN¥77m ÷ (CN¥2.7b – CN¥908m) (Primarily based on the trailing twelve months to December 2023).

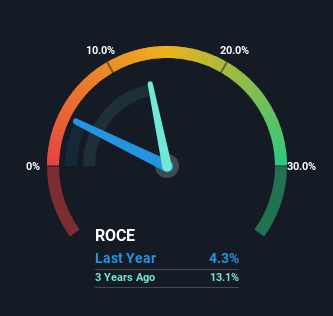

Subsequently, Shanghai Newtouch Software program has an ROCE of 4.3%. By itself that is a low return on capital however it’s according to the trade’s common returns of 4.4%.

Try our newest evaluation for Shanghai Newtouch Software program

Whereas the previous isn’t consultant of the longer term, it may be useful to understand how an organization has carried out traditionally, which is why we now have this chart above. If you would like to take a look at how Shanghai Newtouch Software program has carried out prior to now in different metrics, you possibly can view this free graph of Shanghai Newtouch Software program’s previous earnings, income and money stream.

What Can We Inform From Shanghai Newtouch Software program’s ROCE Pattern?

On the floor, the pattern of ROCE at Shanghai Newtouch Software program would not encourage confidence. During the last 5 years, returns on capital have decreased to 4.3% from 15% 5 years in the past. Nevertheless, given capital employed and income have each elevated it seems that the enterprise is at the moment pursuing progress, on the consequence of quick time period returns. If these investments show profitable, this will bode very effectively for long run inventory efficiency.

On a aspect notice, Shanghai Newtouch Software program has accomplished effectively to pay down its present liabilities to 34% of complete property. So we might hyperlink a few of this to the lower in ROCE. Successfully this implies their suppliers or short-term collectors are funding much less of the enterprise, which reduces some components of danger. For the reason that enterprise is principally funding extra of its operations with it is personal cash, you could possibly argue this has made the enterprise much less environment friendly at producing ROCE.

Our Take On Shanghai Newtouch Software program’s ROCE

Though returns on capital have fallen within the quick time period, we discover it promising that income and capital employed have each elevated for Shanghai Newtouch Software program. Moreover the inventory has climbed 69% during the last three years, it might seem that buyers are upbeat concerning the future. So ought to these progress traits proceed, we might be optimistic on the inventory going ahead.

On a closing notice, we discovered 3 warning indicators for Shanghai Newtouch Software program (2 cannot be ignored) try to be conscious of.

Whereas Shanghai Newtouch Software program is not incomes the best return, take a look at this free listing of firms which are incomes excessive returns on fairness with strong stability sheets.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Shanghai Newtouch Software program is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.