Just a few weeks in the past, I obtained a final minute invitation to take part in a livestream panel discussing Nvidia. On the time, there was a wild conspiracy making the rounds on Twitter concerning the firm’s outcomes. This panel was clearly going to discover these in depth, and if nothing else, I used to be intrigued by who was behind the wild rumors and the way they benefited from them.

Editor’s Be aware:

Visitor writer Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed development methods and alliances for corporations within the cellular, networking, gaming, and software program industries.

So I attended the panel, listened (usually in shock at what I heard), and pushed again the place I might. The entire expertise was a bit unsettling, staring into the mouth of the Web rumor machine doesn’t give one religion in humanity.

We’re not going to dig into that principle, nor are we going to hyperlink to any a part of it. For essentially the most half, these rumors appears to have subsided and we don’t need to add any oxygen to the eye machine. Nonetheless, I needed to put out my views on Nvidia, to set the file straight on how I view the corporate and its present outlook.

As everybody is aware of, Nvidia’s inventory is on a tear proper now, up 200+% this 12 months alone, solidifying its place as the perfect performing semiconductor inventory most likely of all time. The inventory has been pushed by two consecutive earnings reviews delivering blow-out numbers.

For a corporation of Nvidia’s dimension to develop earnings this a lot in such a short while might be one thing most of us will solely see as soon as in our careers. Actually sturdy numbers. This sequence of sudden surprises might be what attracted the eye of the rumor mill, with a lot consideration centered on the corporate taking a opposite place goes to generate an viewers on-line.

… to be clear, Nvidia’s outcomes are pushed by actual demand.

Nonetheless, to be clear, Nvidia’s outcomes are pushed by actual demand. The software program world is scrambling to meet up with the potential provided by transformer-based AI fashions. There’s a enormous change happening within the panorama and nobody desires to be left behind. As I’ve famous previously, Nvidia has a lock available on the market for AI coaching semis proper now, a place that’s unlikely to alter any time quickly. So all that curiosity in AI interprets into large enterprise for the corporate.

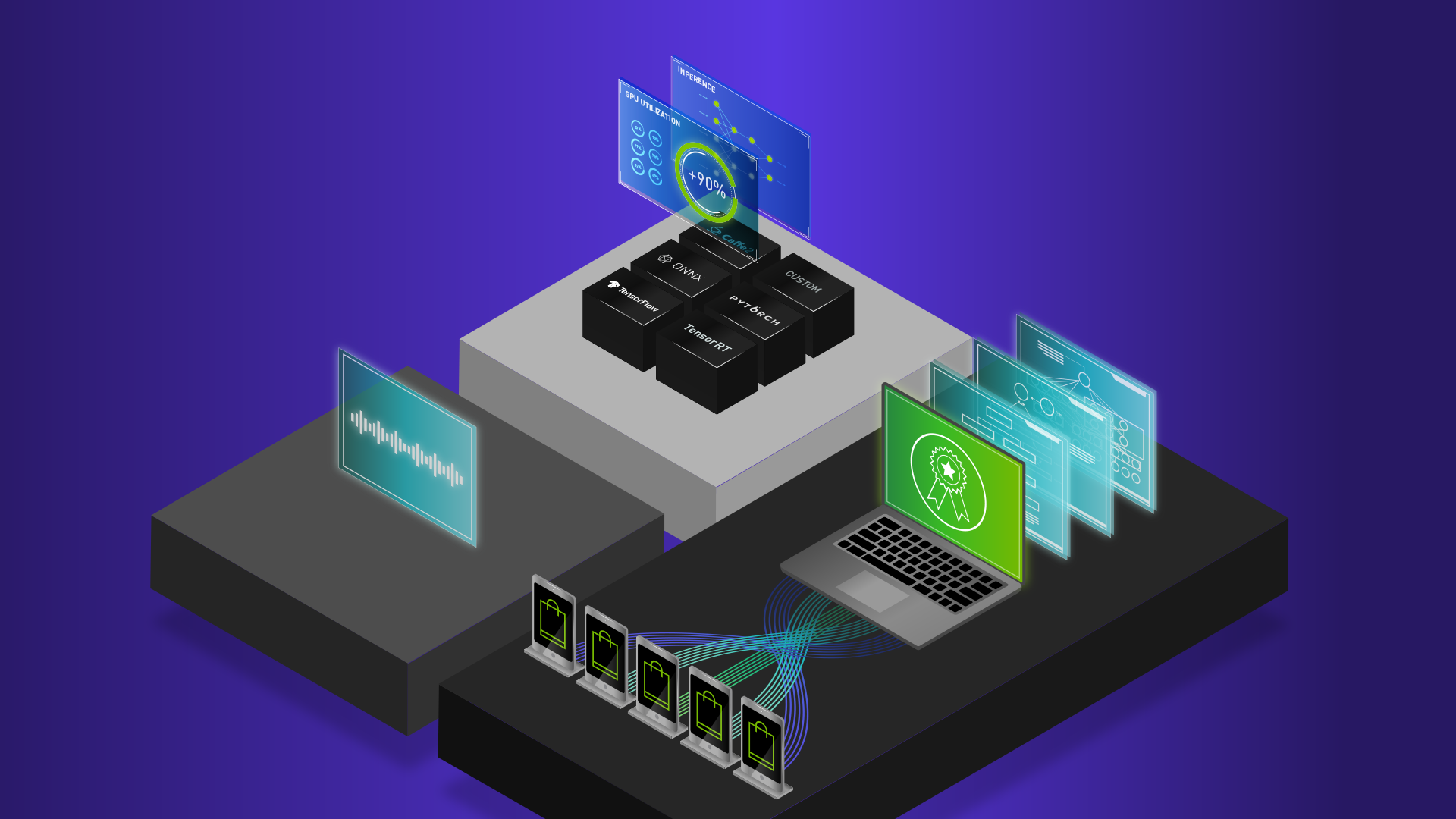

Furthermore, the corporate has spent the previous few years beefing up their choices for the cloud. I wrote about this about 18 months in the past, when their analyst day shows made it clear that Nvidia was laying declare to dominance in the info heart. This implies they’re promoting much more than simply GPUs for the cloud – additionally they have CPUs, networking chips and a number of programs tying every part collectively. In addition they have deployed some surprisingly sturdy software program choices, one thing which challenges all their semis friends.

All of which is to say that they’re very effectively positioned proper now, using the wave of AI, gaining share and garnering these large earnings.

Will it final? Right here I would like to interrupt the query into two time frames.

Over the following 12 months or so, the corporate has all that wind in its sails, however that won’t final eternally. Proper now the corporate is struggling to fulfill demand, however in some unspecified time in the future subsequent 12 months, provide will seemingly catch up. No firm can sustain the tempo that Nvidia is on, and semis are cyclical, so inevitably their earnings will pause. Couple that with the actual fact the Nvidia has by no means been terribly good at forecasting quarterly demand, or cared to get higher at it, and sure ultimately the inventory will take successful.

Given the super-premium a number of the corporate is buying and selling at presently, any miss will see the inventory trashed. Over the previous ten years, Nvidia’s inventory fallen over 5% in a day 53 instances. As a lot because the 30-year view of their inventory is up and to the precise, zoom in on any two to a few 12 months interval on that chart and it seems extra like an enormous zig zag.

All of this makes it a horrible inventory for retail traders. Skilled traders are spending immense sources proper now to get a finger on the heartbeat of Nvidia’s progress, which supplies them an enormous edge versus retail traders intrigued by what they could see or hear on Twitter – tread rigorously – and to be clear, I don’t personal any Nvidia shares, and joking apart, I cannot be shopping for any.

Over the long run, there’s nonetheless loads to love about Nvidia. Sure, curiosity in AI has gotten out of hand. And sure, there’s lots of hyperbole happening within the section. Exactly forecasting demand for AI semis could be very difficult with lots of shifting elements – shopper adoption, software program fashions, killer apps (or lack thereof), and so forth.

Nonetheless, the advances in compute that transformers, LLMs and different AI fashions provide are actually clear, and these capabilities will get woven into the material of our digital lives it doesn’t matter what. There’s nothing on the horizon that appears set to problem Nvidia’s place in that any time quickly. They might not be capable to proceed an endless sequence of monster earnings surprises, however they are going to take part in a significant approach.